A recently released Securities and Exchange Commission advisory warning the public against groups sending invitations to invest in “online paluwagan” circles reveals how the familiar group and investments savings system has survived and evolved to embrace the rise of the internet and social media.

The newest internet scam?

ONLINE PALUWAGAN? SCAM YAN!

There are groups in social media luring investors to give money in exchange for huge return. These are professional scammers and are illegal. If you have information about these, report to the proper authorities.

SOURCE: https://t.co/Ssq2GrTwr9 pic.twitter.com/oMrg4X3uTA

— Atty. K (@Legally_K) May 8, 2018

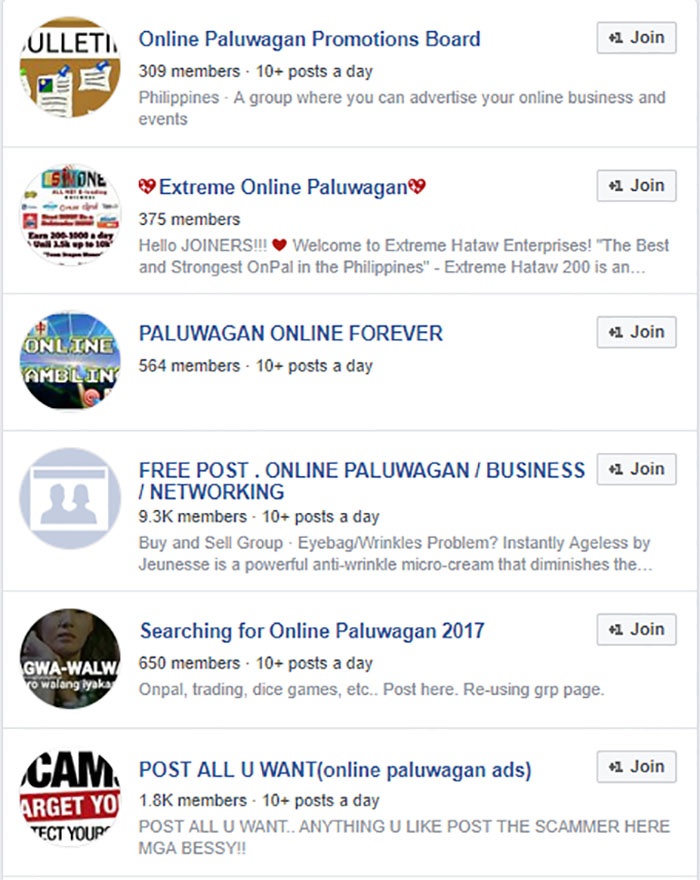

The SEC advisory lists 30 groups allegedly involved in the ponzi scheme. The groups supposedly lure investors into joining paluwagan circles with promising returns upon their payout schedules. The scammers peddle promises of returns based on exorbitant interest rates, ranging from as 10 percent up to 757 percent.

However, the administrators in charge of redistributing the payouts are unable to refund the entire amount owed to the participants.

Social media is abound with stories of similar organizations using deceit to profit at the expense of others.

One Facebook user related how her passport picture was used by a certain Melody Joy Rivas as identification to gain the trust of potential investors in a paluwagan circle called “Millionaires Club” last year. The group does not appear on the list circulated by the SEC.

What is paluwagan?

Paluwagan is a popular system of saving money in Filipino social circles.

One Reddit user provides a concise explanation of how the system works.

Ideally, paluwagan functions as a money pool to encourage close-knit circles to help each other save money. But as recent stories reveal, it has provided scammers a means for profiting off the unwitting.

In 2002, former Department of Interior and Local Government Secretary Jose Lina Jr. recognizing the prevalence of the paluwagan system in small communities advocated a nationwide paluwagan system that would discourage individuals from patronizing jueteng gambling circles.

He cited the success of the “Bayanihan Banking Centers” then set up in Pasay City to argue for the paluwagan system.

Yes, there’s paluwagan outside the Philippines.

The system is not endemic to the Philippines. Internationally, paluwagan circles are known as “rotating savings and credit associations” or ROSCAs.

A paper published in 1989 claims that the system may have started as early as the 13th century, a precursor to modern finance. According to Yoichi Izumida, author of the paper, the Japanese called it “kou.”

Meanwhile, a World Bank study published in 2014 observed that 17 percent of adult males in developing countries participate in semi-formal systems such as the ROSCAs.

Tech author Sunil Sanchev, who cited both articles in discussing the possibility of digital ROSCAs recognized the risks to the system.

“Early attrition is an obvious risk and there’s no way to guarantee that an individual’s turn in the rotation will coincide with their need for financing,” writes Sanchev in his 2016 article.

Why do people still support the paluwagan system?

Despite the risks, many still participate in the tradition.

One Reddit user in another discussion on paluwagan gave an explanation for its continued patronage.

Finance blog Collaborative Finance claims that ROSCA participants join so as to commit to saving, since participants cannot use the money after they deposit their contribution.