MANILA, Philippines –- The reduction of corporate income tax and modernization of fiscal incentives to investors were the highlights of the second proposed package of the Comprehensive Tax Reform Program (CTRP) that the Department of Finance (DOF) submitted to the House of Representatives this week.

Package 1 of the CTRP, called the TRAIN (Tax Reform for Acceleration and Inclusion) Act, was signed into law on December 19. It reduced the personal income tax rates, but increased the excise taxes of fuel, automobiles and sweetened beverages.

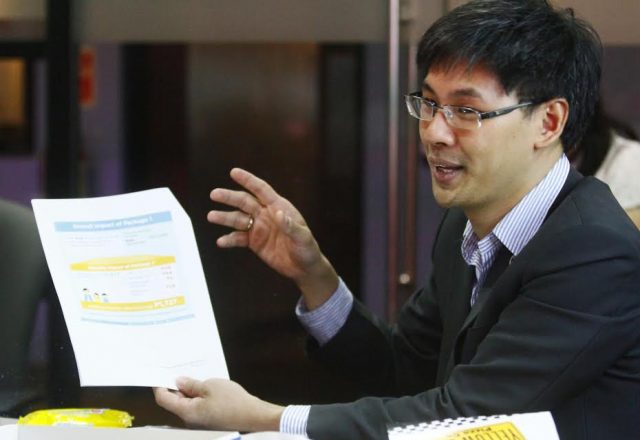

Package 2 of the CTRP proposes to “gradually lower the corporate income tax (CIT) rate from 30 to 25 percent, while modernizing incentives for companies to make these performance-based, targeted, time-bound and transparent,” Finance Undersecretary Karl Kendrick Chua said.

“Through this tax reform package, the government would be able to ensure that incentives granted to businesses generate jobs, stimulate the economy in the countryside and promote research and development; contain sunset provisions so that tax perks do not last forever and are reported, so the government can determine the magnitude of their costs and benefits to the economy,” Chua said.

He said incentives enjoyed mostly by big businesses such as income tax holidays and other perks with no time limits need to be corrected as it is costing the government over P300 billion annually in foregone revenues.

According to Chua, compared to other economies in the Association of Southeast Asian Nations (ASEAN), the Philippines imposes the highest CIT rate but is among those at the bottom in terms of collection efficiency, resulting in a high rate but narrow tax base.

The Philippines currently imposes a CIT rate of 30 percent but with a tax collection efficiency rate of only 12.3 percent, while Thailand’s CIT rate is only 20 percent but it collects almost triple–a 30.5 percent efficiency–that represents 6.1 percent of its GDP.

Vietnam’s CIT rate is 25 percent but it collects even more with a 29.2 percent tax efficiency rate representing 7.3 percent of GDP. Malaysia’s 24 percent CIT generates a 27.1 percent efficiency rate in terms of collecting taxes, which is 6.5 percent of GDP.

Chua pointed to the “flawed and outdated system” that provides tax incentives to companies under 123 investment laws and 192 non-investment laws as the reasons for the country’s low CIT collection efficiency.

Under the Philippine tax code, all corporations, unless receiving fiscal incentives, have to pay a regular CIT rate of 30 percent or a minimum CIT rate of 2 percent of gross income beginning the fourth taxable year immediately following the year in which a corporation commenced its business operations, when the minimum income tax is greater than the regular tax. The optional standard deduction for corporations is 40 percent of gross income under the tax code.

Citing 2015 data, Chua said income tax holidays and special rates account for P86.25 billion of the revenue losses, while custom duty exemptions account for P18.4 billion.

Exemptions from paying the VAT on imports led to P159.82 billion in foregone revenues; and local VAT, P36.96 billion, although part of this tax will eventually have to be refunded because these are imposed on exporters, he said.

He added these incentives totaling P301.22 billion do not yet include exemptions from the payment of local business taxes and the estimates on tax leakages.

In terms of income tax incentives, the government, in effect, gave away P61.33 billion to companies in 2011, which went up to P88.17 billion in 2014.

Customs duty exemptions, however, have gone down from P82.97 billion in 2011 to P38.04 billion in 2014 owing to the various free trade agreements signed by the Philippines with other countries.

“So on average, we gave away up to 2 percent of our GDP in income tax and custom duties exemptions,” Chua said.