To start with, AI really is a big deal. The Harvard Business Review calls it, “the most important general-purpose technology of our era.” According to some pundits, AI could contribute up to US$15.7 trillion to the global economy in 2030 – or more than the current output of China and India combined.”

Many companies have seen the opportunity and the investments are flowing in. According to McKinsey1, tech giants have already invested 20-30 billion dollars in AI technology. As a result, the big companies are developing their proprietary AI technology: IBM has its “Watson,” Google has “Deep Mind” and Hitachi has “H”.

Defining AI

So, what is AI? The Merriam-Webster dictionary defines AI as “a branch of computer science dealing with the simulation of intelligent behaviour in computers; the capability of a machine to imitate intelligent human behaviour.” That’s a very broad definition and a variety of computer systems would qualify. For example, many of us carry multiple AI systems, such as the Siri smart assistant in our smart phones or spam filtering engines in our e-mail apps.

There is another important term – Machine Learning (ML). In fact, this branch of AI has recently become a scientific discipline on its own, giving a machine the ability to learn and improve its performance, without the need for any human interaction.

Riding the third wave

Although AI may seem to be fairly new, it has actually been around in one form or another for at least 60 years. We are now riding the third wave of AI, and there are two main factors that make this wave so important. The first is a significant increase in computational power and a corresponding decrease in costs. The second is the massive pool of data that the Internet and mobility has made available, and which can be used to train AI models.

However, despite all the hype, according to IDC2, only one third of companies are planning to use machine learning or other AI technologies inside their enterprises. The reasons for their reluctance to embrace this set of techniques? Lack of familiarity and a talent gap.

Blockbuster benefits

In Hollywood movies, artificial Intelligence means computers or human-looking robots that can learn on their own and make creative decisions in new situations. That’s still science fiction. So, what can AI really do?

Modern AI systems are really more like Assisted or Augmented Intelligence solutions which perform specialised tasks. And they can learn and perform some tasks, such as recognizing complex patterns, synthesizing information, drawing conclusions, and forecasting – even better than humans. These are tasks that not long ago we assumed could only be done with a human brain.

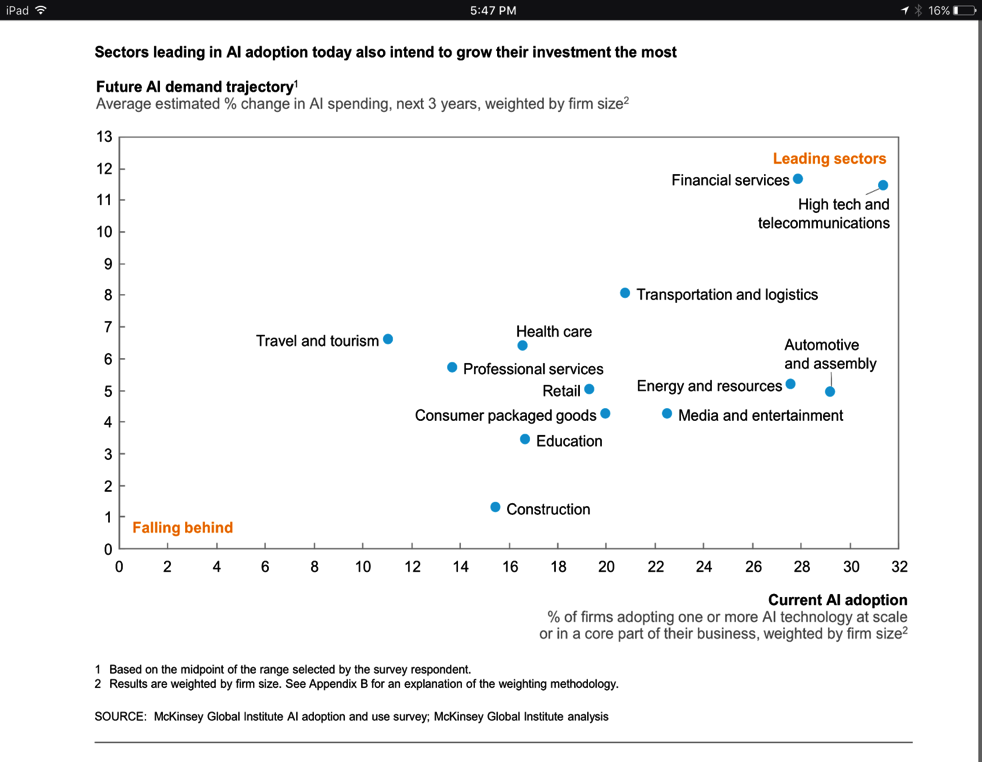

As the capabilities of AI have expanded, so has its usefulness in a growing number of fields. According to a McKinsey study, early AI adopters are seeing increasing revenues. The biggest benefits are probably in the financial sector, and IDC expects the FSI industry to invest the most in AI/Cognitive systems.

There are plenty of potential applications for machine learning systems in the finance sector. According to PWC1, the highest potential lies in fraud detection and AML (anti-money laundering), front and back office process automation and personalised financial planning. And the benefits can be tremendous.

For example, a brokerage firm is using Hitachi’s H technology to combat fraud. It compares fraudulent data with ordinary transactions to identify patterns that indicate a higher probability of frauds for the trading/brokerage platform.

Start fast

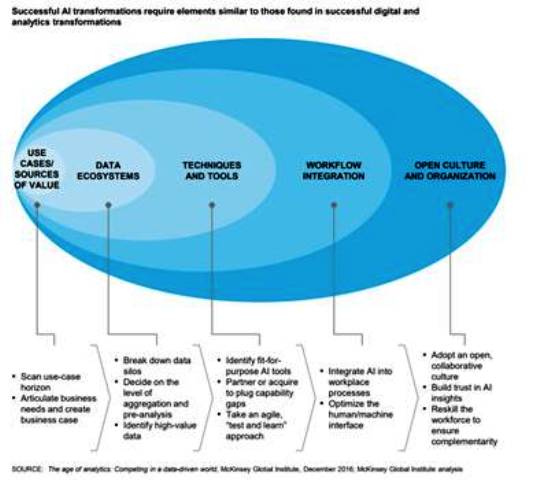

It is clear that companies must start adopting AI technologies to stay ahead of the pack. In my experience, one of the most useful frameworks for adopting AI technology is the one developed by McKinsey.

The starting point should be identifying a business problem where AI can add the most value. The problem doesn’t have to big. Starting fast and unlocking the benefits of using AI as early as possible is more important.

The next step is finding the talent. With a flowering AI eco-system – which includes start-ups, cloud-based tools and research bodies – companies can now find the right resources much more quickly by collaborating, rather building their own data science team.

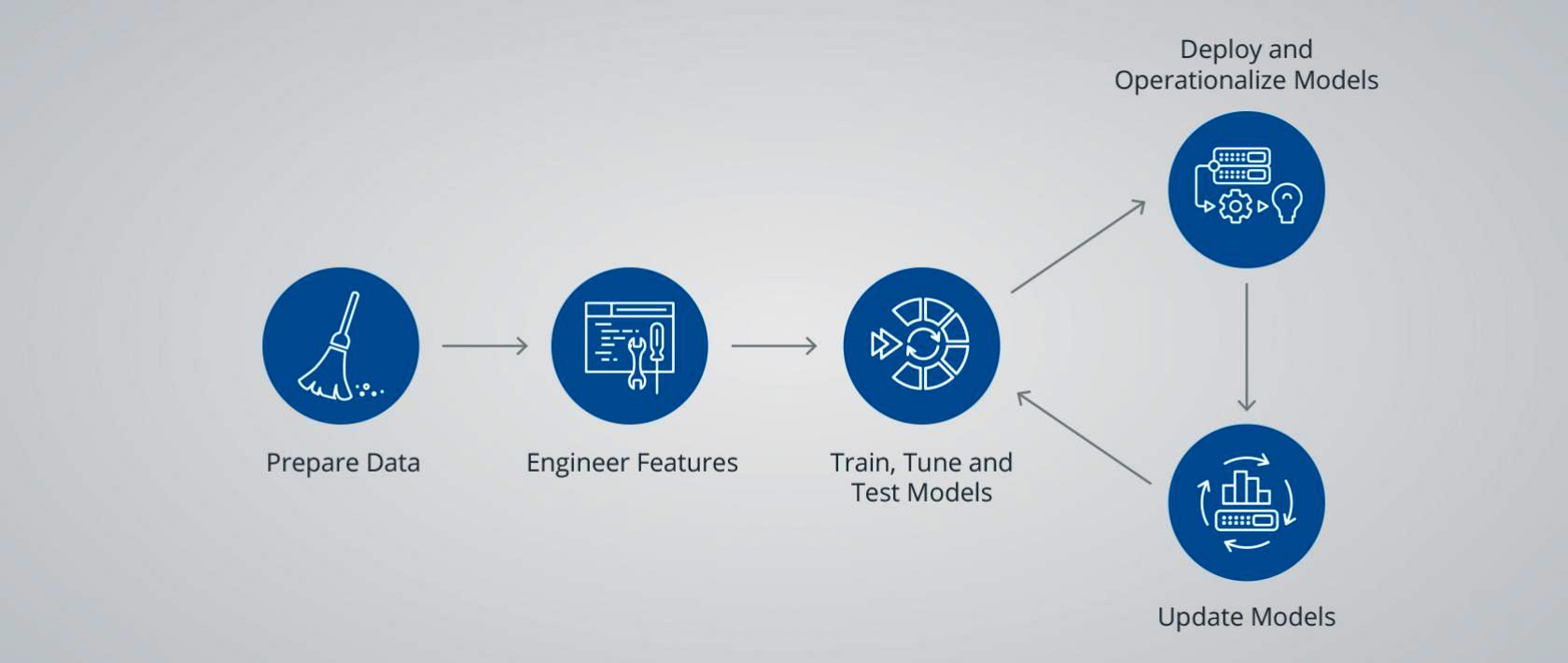

The third step is to identify the right data to build AI models. The main challenge here is to break down the different data silos and put all relevant data together. After the right data has been identified, the remaining 80% of the effort is spent on data engineering.

Once the model is working in a test environment, it needs to be operationalised and integrated with other systems. Data analytics solutions provided by Pentaho, a Hitachi Group company, can automate a sizeable chunk of this work.

Lastly, project results need to be validated against business objectives. Adjustments if needed should be made in an agile, iterative and, most importantly, a measurable way.

Don’t get left behind

AI may not yet be capable of solving all of the world’s most pressing problems. But, the status quo of dividing up work between minds and machines is breaking down very quickly.

Companies that don’t step up are going to find themselves at an increasing disadvantage, compared with rivals who are willing to use AI and effectively integrate its capabilities with those of its human employees.