Author Cesar Polvorosa Jr. is a business school professor of economics, world geography, and international business management in Canada. He is also a published writer in economics, business, and literature.

The historic role of the 1986 EDSA Revolt was to restore democracy to the Philippines, deeply flawed it may be. Relatively good governance turned around the economy from flat-lining during the twilight of the Marcos Regime to attaining a 40-year high annual average growth of 6.2% since 2010.

Some incremental gains had been made against poverty and inequality during the past few years such as the slight decline of poverty incidence to 26.3% in the first quarter of 2015 from 28.6% in 2009. Even granted that these advances are too tentative at present, why are many Filipinos reluctant to recognize the gains?

Uneven economic progress is the essence of capitalism especially of the neoliberalism variant pursued by many countries in the last few decades. For instance, rising Philippine incomes brought by economic growth and political stability boosted car ownership (registered new motor vehicles in 2014 alone reached 1.5 million) but severe infrastructure deficit generated horrendous traffic jams and pollution which obliterated any perception of economic gain.

There are parallels with this uneven progress in other countries. While Chinese economic growth has lifted hundreds of millions out of poverty it has also aggravated pollution and widening unequal income distribution. Indian economic growth has been marked by the rise of its IT industry but there had also been many Indian farmer suicides due to mostly high levels of debt that is the tragic downside of market deregulation.

Resolving poverty and inequality will be paramount in the national and global agenda for the next thirty years.

No social transformation

The roots of the uneven progress can be explained by history. A centuries’ old stratified society under the Spanish encomienda system was maintained with American rule and shaped as the “Cacique Democracy” in the Philippines (Benedict Anderson). This is evident in the growing post-EDSA economy that continued to exhibit pronounced dualistic patterns or a modern economic structure coexisting with traditional and underdeveloped sectors.

Spending is fueled by OFWs’ remittances and BPO and call center employees’ incomes while many sectors remain stunted with workers at barely subsistence levels. There is a tiny elite sheltered in grand mansions in gated communities while many of the teeming masses live in squalor in shanties along filthy and flood-prone esteros.

Thus, the Gini Index used to measure income inequality is at 43 for the Philippines (2012, World Bank) which is high by international standards. Modern malls that can rival Western shopping centers coexist with traditional wet markets. Economic liberalization energized the travel sector but the main Manila Airport remains shoddy by global standards. Bureaucratic inertia among others has delayed badly needed infrastructure projects.

At the same time, peace and order continues to be a main concern in the Philippines with high crime rates in comparison to especially East Asian countries. There is basis for the fear, discontent, and restlessness of Filipinos regarding the prevalence of crimes in the country.

What would be the most likely scenario then for the Philippine economy in the next three decades assuming business as usual or no radical change in policies? What can be the important policy initiatives to realize inclusive economic development? Of course, the further into the future we fix our gaze the more uncertain it becomes because of random events, geopolitics, and the role of individuals in shaping history.

By the late 1950s, the potential of a revitalized Japan to become an economic power had been recognized. But economists also got it wrong on Myanmar and the Philippines. A repressive military junta came to power in Myanmar and a rapacious dictatorship impoverished the Philippines. A prosperous Argentina in the early 20th century attracted European immigrants until it got mired along with much of Latin America in the debt crisis and the unsettling boom and bust cycle.

A possible Latin American future?

The renowned historian Arnold J. Toynbee reportedly stated that “the Philippines is a Latin American country that was transported to the Orient by a gigantic marine wave.” Though sheer hyperbole it highlighted that there are many comparable characteristics between Latin America and the Philippines due to their Spanish colonial past. Other resulting cultural influences include the influential role of Roman Catholicism in society and the similarities in language and customs. Instead of towering pagodas and temples, the Philippine landscape features soaring church steeples.

In the modern era the US plays a dominant role in their political and economic affairs. Thus, there is also the saying in the Philippines that “Filipinos think like Americans, feel like Spaniards, and act like Malays.” This cultural familiarity is often the glue that easily binds Latin Americans and Filipinos together.

Similarly, an exploitative political and economic elite (originally descended from the Spanish conquistadores) spawned extractive institutions, political dynasties, social and economic inequality, and corruption in Philippine and Latin American societies. Likewise, high levels of inequality and corruption are accompanied by alarming crime levels.

Such a class structure engendered a dispossessed and disenchanted peasantry leading to social unrest and armed insurrection. At various times Filipinos and Latin Americans had to endure festering insurgencies – NPA (Philippines), FARC (Colombia), Sendero Luminoso (Peru), Zapatistas (Mexico), etc.

Periodic governance crisis contributed to a boom and bust cycle of the economy. The oligarchy dominated oligopolies limited job opportunities and helps perpetuate a vicious cycle of poverty. The Latin American template also serves as a cautionary tale for descendants or representatives of repressive ruling families that occasionally succeed or return to power.

There are however important distinctions between the Philippines and Latin America. The Americas experienced dramatic racial and cultural transformation as it evolved into a European settler society and subsequently manifested a deeper Spanish imprint than the Philippines.

The Europeans brought in African slaves to replace the natives that died off en masse from disease, hard labor, and starvation. Eventually, the resulting Latin American Gini indices are generally worse than the Philippines. Pre-Columbian Indigenous cultures such as the Aztecs of Mexico continue to exert their influence in various degrees. On the other hand, the Philippines was significantly influenced by China, India, Indonesia, and Malaysia.

As noted in Part 1, the Marcos Regime pillaged the Philippine economy until the country gained the cringe-worthy reputation of “The Sick Man of Asia.” The Philippines was a weakling in stark contrast with its dynamic neighboring countries especially Japan, South Korea, and Taiwan, which were sprinting to economic prosperity in the past decades.

The Philippines, just like many Latin American economies stumbled through boom and bust cycles and into a debt crisis that degenerated into a lost decade or more in economic development. Likewise, the Philippines just like Latin American countries was ahead of East Asia in the 1950s-1960s. Then, East Asia caught up and left behind Latin America e.g. South Korea overtaking Mexico (1969), Brazil (1978), and Argentina (1988) (World Bank).

The Marcos Regime economic outcomes resembled more that of Latin American despots than the Asian strongmen that produced the economic miracles of that era – Park Chung Hee (South Korea), Mahathir Mohammed (Malaysia), and Lee Kuan Yew (Singapore).

Using the lens of “embedded autonomy” of political sociologist Peter B. Evans, the Philippine state of the time was “predatory” in contrast to the “developmental states” of East Asia. While Philippine economic stagnation pale compared to Zaire, the performance disparity is clear. Some of these Latin American dictators that ruined their countries were resilient such as Somoza (Nicaragua) and Duvalier (Haiti) as their tragic legacy came back to haunt their countries through their sons as political heirs. Other iron fisted Latin American rulers include Peron (Argentina), Pinochet (Chile), and Trujillo (Dominican Republic).

Mexico among Latin American nations is the most comparable in imagining a future Philippines largely because of history and demographics. The two countries are ranked 10th (Mexico at 129 million) and 12th (Philippines at 101 million) in the world in population sizes. Because of their significant diasporas both Philippines and Mexico are globally ranked 3rd ($29.7 B) and 4th ($25.7 B) in remittances respectively (2015F, World Bank). The US is highly influential in the economy and politics and as a work and settlement destination for both countries. Finally, and most important, both countries had a common Spanish heritage and for more than 250 years during the colonial period the Philippines was governed by Spain through Mexico under the Viceroyalty of New Spain with profound influences in culture, class structure, and governance.

Under a business-as-usual scenario the Philippine economy will likely continue to grow at robust rates and resemble more Mexico as a relatively high per capita country rather than East Asia. Mexico had 2014 GDP PPP (gross domestic product purchasing power parity) per capita of $17,950 vs. the Philippines’ $6,974 but face many social and political challenges deeply rooted in its class and social structure. These are high crime rates, alarming inequality, and uneven development and urban slums coexisting with palatial homes. A growing Philippines confronts these similar social and political issues that can imperil its ascent to the ranks of developed countries.

Over the next few years, if it hasn’t happened yet the Philippines can easily reach the GDP per capita of Guatemala ($7,550), El Salvador ($8,060), and Paraguay ($8,476)(2014 IMF). In fact, these countries and the Philippines have similar HDI (Human Development Index) scores (between .627 to .679) and are classified as Medium Human Development countries.

A need for a new economic model

Philippine economic performance in the past decades to the present revealed that the 6-7% GDP growth range seems to be the maximum sustainable growth trajectory. In comparison, East Asian countries grew an average 8-10% to achieve developed status within a generation. Impacts of sustained small growth differences become significant over time as economists using the Rule of 70 estimate the years it takes for the economy to double in size is to divide 70 by the growth rate of the GDP. Thus, if the growth rate of South Korea is 10%, the rule of 70 predicts it would take 7 years (70/10) for its real GDP to double.

It is vital to enhance growth rates but the next several years is expected to be an era of slow growth for the global economy in what economists have referred to as “secular stagnation.” In the continuing economic malaise since 2008 with ineffective monetary and fiscal policies, the discourse has turned to the possible transition of the world to a post mainstream capitalist future. The triggers for structural volatility in the world economy are due to unsustainable economic relations and business practices, rising economic inequality and greater automation.

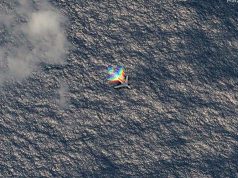

The advent of the Fourth Industrial Revolution or the collective term for the current automation, data exchange, and manufacturing technologies will usher in transformative change in the competitive position of countries in the world economy. In the coming years the advances in 3D Printers, robotics, drones, driver-less cars and trucks, software-driven financial services, internet of things, VR, lab-grown food, etc. will foster greater automation and labor displacement. If the West plagued with labor shortages are concerned with accelerated automation, how much for a labor surplus country like the Philippines?

The Philippine advantage is a vibrant population base – the demographic dividend creates a huge domestic market that is likewise a double-edged sword if jobs become scarce in the economy of the future.

Upheavals and protracted political instability, anemic growth combined with lower oil prices especially in the MENA countries will increasingly threaten the dependency on the OFW-based developmental model which will decline in significance if not on its way to obsolescence.

Arrested development: Avoiding the middle-income trap

Recent research has focused on the finding that while a few countries leaped into high-income status in a span of a few decades such as South Korea and Japan, the majority appeared to be mired in a “middle-income trap.” According to the World Bank only 13 of 101 countries classified as middle income reached high income status as of 2008.

Economies of Malaysia, Brazil, and South Africa appeared to have plateaued. Unless Thailand is able to bridge the fault lines in its society it is also a candidate for the middle-income trap.

Countries get snared in the middle-income trap as their existing economic models had lost their competitive edge. These causes include lack of innovations, productivity slowdown, inability to compete in overseas markets and to cope with the transition from labor intensive to capital intensive industries, unresolved governance issues, and decreasing returns to investments.

The existing Philippine development model can likely take the country to respectable growth for the next 5 years but sustaining vigorous increases beyond that need creativity and bold initiatives. In turn, this will extend the country’s take-off stage consisting of a rapid, sustained expansion that enables the country to achieve high-income status just as it enters the maturity stage. So how can the Philippines avoid the middle-income trap?

The role of institutions

The institutional approach to development emphasizes the role of formal institutions (laws, regulations) and its interplay with informal institutions (culture, ethics, norms) in shaping the economic and social outcomes of a country. Major contributions to the institutional approach were made by prominent economists Douglass North, Oliver Williamson, Ronald Coase, etc. A recent influential work espousing this approach is “Why Nations Fail” by Robinson and Acemoglu (2012).Thus e.g. entrepreneurship is encouraged through appropriate laws, infrastructure and financing support, upholding property rights and these will eventually develop an entrepreneurial culture – innovative mind set, work ethic, etc..

Some of these policy interventions to avoid the middle-income trap for the Philippines that can be comprehensively analyzed using the Institutional Approach and are inter-related and mutually reinforcing include:

1. National Dream/Vision The articulation of a National Dream or Vision serves to unify people toward concerted action to achieve a common goal as it fosters the feeling of a shared destiny. Thus, the Chinese Dream is the restoration of past national glory and the achievement of fully developed nation status by 2049, the centennial of the People’s Republic. Japan and South Korea were invigorated by the challenge of making their countries rise from the ashes of war. It’s always about prosperity but there is also a singular aspect that makes the nation identify with it. The American Dream is founded on individualism and equal opportunity. But what is the Filipino Dream/Vision? If it’s a dream about prosperity what makes it particularly Filipino?

2. Good governance and economic reforms The Philippines had been buffeted by good governance crisis and scandals during the past decades that had driven away investors and derailed economic growth. It’s imperative that the country maintains good governance reforms through continuing prudent macroeconomic management, transparency in government contracts, limits to political dynasties, achieving peace and implementing law enforcement programs, simplifying business procedures and processes, strengthening IP rights, streamlining of agencies, and the dismantling of oligopolies, etc.

3. Infrastructure Horrible traffic jams in Metro Manila and other major cities in the Philippines are just the tip of the iceberg of the terrible state of infrastructure in the country. The Philippines has an overall infrastructure that is the worst in ASEAN (IMF). How important is infrastructure in the country’s future? A February 2016 IMF Working Paper (WP/16/39) has concluded that significant infrastructure investments in the Philippines can potentially lead its GDP growing at 10-11% per annum for the next several years – which was the growth rate of top performing Asian countries. Infrastructure enhancements can focus on digital technologies and connections and should also include preparing for extreme conditions in the era of climate change: flood control measures, water reservoirs, typhoon shelters, etc. In the coming decades there should be greater emphasis on clean and renewable energy for transport, industry, and smart cities.

4. FDIs and SMEs Dismantling the oligarchy dominated oligopolies is futile with many restrictions on foreign investments and disadvantages on community-based SMEs and organizations. Bold initiatives are needed such as relaxing the ownership restrictions on FDIs. A micro- and SME-centered development strategy will spread the fruits of development across regions and broaden the ranks of the middle class to form the core of the anti-poverty program. SME-centered means inculcating an entrepreneurial mindset as part of the formal education. When these aspiring entrepreneurs start they have access to adequate resources to support their firm: financing, infrastructure, networks, technical support, etc. Eventually, a broader and more prosperous middle class will be better educated and that leads to good governance.

5. STEM education More than ever, the edge for the economies of the future will be based on science & technology, engineering and math (STEM) education. This is especially the strategy of highly successful neighboring countries Japan, South Korea, and Singapore. Increasingly, the technological edge in the Knowledge Economy consists of intellectual capital with the country identifying its market niche. The country can consider a nationwide system of providing loans to students within specified income levels so they can obtain university education. A combined focus on SMEs and STEM Education especially geared for the digital era can make the country a hotbed of innovation and entrepreneurial culture through the build-up of human capital.

6. Rebalancing of the economy and industrial policy/strategy While the economy is being geared toward greater export competitiveness it would be a prudent strategy to achieve a balanced domestic market and export-driven economy. Future low growth and volatility are expected to adversely affect export dependent economies. Having a big population means that the Philippines can deviate from the export dependent strategy of small nations like Singapore and Netherlands. Another rebalancing is to develop manufacturing, which has the greatest labor absorptive capacity even as the country continues to excel in BPO and service sectors, shipbuilding, and IT. An industrial strategy is to develop the most promising industries of the future tailored for Philippine capabilities and strategize the move up the technology ladder. Disruptive technologies can be harnessed through international collaborations and linkages among the different sectors (partly incorporated in the Comprehensive National Industrial Strategy or CNIS), etc. Consistent likewise with the Green approach in infrastructure projects, there should be a focus on environmentally-friendly technologies to enhance sustainable development complemented by reforestation and conservation programs.

7. Basic income initiative Going beyond the Conditional Cash Transfer Program is a proposal to provide a basic income for every citizen. Such a scheme is being considered mainly in European countries, Canada, and Japan. While a main objection is that it provides disincentives for work there are other positives (e.g. mothers spend more time with growing children). The other main issue is the financing which can be addressed by tax reforms, enhanced tax effort, as well as some savings as the scheme can potentially replace a number of social services. It can become a major income redistribution scheme and a solution to the issue of inequality in the country.

The Philippines in mid-21st Century

With an impressive economic growth since 2010, the Philippines had been widely heralded as the next Tiger economy of Asia. With a young and growing population of more than 100 million and continuing buoyant expansion, the Philippine economy is widely expected to grow from its 2014 level of about $695 billion (PPP) (PricewaterhouseCoopers) (PwC) and reach $1.5 trillion by 2030 – which is about the size of the Turkish economy in 2014. If the Philippines fulfills the vital preconditions for rapid growth including adequate infrastructure then the groundwork is laid for achieving around 10% increment per annum during the take-off stage and the doubling of the economy will come even sooner.

Setting our sights further afield to 2050 or about two generations after the EDSA Revolt, the forecasts for the Philippines are glowing and highly inspiring. PwC came out with its “The World in 2050 Report” (2015) and in its 2050 ranking of countries by GDP (PPP), the Philippines after growing respectably in the previous three decades would be a $3.5-trillion economy and ranks at #20 ahead of regional rivals Thailand (#21), Vietnam (#22), and Malaysia (#24). This is significant as Thailand caught up with the Philippines in per capita income in 1983-1984 and left it behind – and now a reconvergence is foreseen by 2050 in size of economy.

Other forecasts also show the Philippines catching up in per capita income. Goldman Sachs is also upbeat about the Philippines classifying it as a member of the N-11 or the Next 11 countries of the world economy with great prospects and forecast it to be the world’s #17th biggest economy in 2050 with GDP per capita at $20,388. HSBC in its own 2050 Report expects that the Philippines will be the 16th biggest economy by that time. These prognostications are remarkable for a country that is ranked as the world’s #30th biggest economy of 2014(PPP) (IMF).

These outlook reports are usually extrapolations assuming a linear path of the country’s economy using main variables such as demographics, investments, and education to make future projections while unable to fully incorporate the structural constraints and major fault lines of society.

As economist Joan Robinson once quipped, “You can’t put culture into an equation.” What kind of society will the Philippines be in 2050? What will be the peace and order conditions and the income inequality structure of the country at that time? If these issues remain unresolved, Philippine society may lurch again to its recurring governance crises of the previous generations that will stifle progress and growth well before 2050.

The country needs to carve out its own path with transformative policies to achieve progress and avoid the middle-income trap as a business-as-usual approach will be ineffectual in the 21st world economy.

At this time, Filipinos can take the first step toward realizing the dream of progress by ensuring they vote effective and honest national government officials starting with the President in the coming elections. Can Philippine administrations starting 2016 implement structural reforms; sustain economic growth in the range of at least 6-7% per annum and foster inclusive development? The Philippines needs at least two more administrations with Presidents of integrity and capability to deepen the reforms, create a critical mass for the economy, and ensure that the fruits of development will begin to be widely felt. Indeed, achieving development and progress is a generational endeavor.

The compelling vision of prosperity for the Philippines in the mid-21st century is best viewed with cautious optimism. After all, this is déjà vu as a similar glorious picture of the country’s future was painted before.

But the stakes are significantly bigger now for the Philippines as prospectively a top #20 economy 30 years hence in a much more complex, competitive, and technologically advanced world. It is imperative that a new generation of Filipinos rise to the challenge to empower the country to break free from the shackles of its history and make full use of its creative genius and talents. The renewed faith on the prospects of the Philippines testifies to the recognition of the fundamental strengths of Filipinos and their capacity to become a progressive and prosperous nation.