TOKYO/TEL AVIV/BOGOTA – In Tokyo’s upscale Ginza shopping district, around the corner from the sparkling storefronts of Tiffany & Co and Cartier, shoppers searching for a new device called iQOS can buy it in a boutique behind a glass façade. The store combines a high-tech aesthetic with the feel of an exclusive club: The young woman at the door says a members-only smoking lounge is upstairs.

The device is advertised under the slogan, “This changes everything,” with a hummingbird in fluorescent green and blue floating in midair. From the small “i” of its name when it was rolled out to the minimalist white box it comes in, the iQOS evokes the marketing-and-design savvy of the American technology giant Apple Inc.

But this little machine is sold by the tobacco giant Philip Morris International Inc. And it isn’t a smartphone.

The iQOS is essentially an electronic cigarette that heats – without burning – plugs of tobacco, releasing tendrils of nicotine-laced aerosol. And the world’s largest publicly traded tobacco company by market value, which has spent more than $3 billion in developing new smoking devices, says iQOS is nothing less than its future.

Philip Morris International says the lack of combustion means iQOS produces far lower levels of carcinogens than regular cigarettes. It’s early days, but iQOS is already bringing in piles of cash. The device drove up sales of the company’s new-generation smoking products to nearly $1 billion in the last quarter, from some $200 million just a year ago.

Wowing consumers with the prospect of a less harmful smoke built on flashy technology is essential to iQOS’ rapid success. Consumers,though, aren’t the only target. Interviews with government officials and trade groups reveal how the company is seeking to sell national authorities on the benefits of the device, before regulators can toss up hurdles.

A key objective: convince governments of iQOS’ benefits so they don’t slap the same taxes and restrictions on the device as they do on cigarettes.

Philip Morris is employing a novel argument: The tobacco plugs inserted into the iQOS device shouldn’t be classified as cigarettes because they do not burn or produce smoke. And the device itself, the company says, is an electronic product and so should not be regulated like tobacco.

In Japan, Philip Morris blitzed officials with the science of iQOS to persuade them to classify the device in a way that would lead to a lower tax rate than cigarettes. In Israel, the company flew in an executive to convince a senior health official of the upside of the device. And in Colombia, the health ministry says Philip Morris launched iQOS without seeking the agency’s approval.

The approach is outlined in internal company documents seen by Reuters.

Evidence that iQOS “is ‘not smoked’ is the most critical element,” says a 2014 PowerPoint briefing on iQOS and other new smoking devices.

Reuters has published that document and others in a searchable repository, The Philip Morris Files.

Other traditional cigarette companies, notably British American Tobacco Plc and Japan Tobacco Inc, have launched similar devices. None have reported anything close to the global sales of iQOS.

The iQOS is championed by Andre Calantzopoulos, Philip Morris International’s chief executive, who in media interviews makes the point that he smokes the device. In September last year, Calantzopoulos told investors it was the company’s “aim to become the undisputed leader” of a new tobacco category it dubs “reduced-risk products.” The goal he said, is to have “RRPs” ultimately replace regular cigarettes.

Philip Morris now has an application pending at the U.S. Food and Drug Administration for permission to market the device in America as being less harmful than cigarettes.

A Reuters investigation published Wednesday identified shortcomings in the training and professionalism of some of the lead investigators in the clinical trials that underpin the tobacco giant’s application to the FDA. Former Philip Morris employees and contractors described irregularities in those experiments.

The company chose Japan as its first iQOS market, launching in late 2014. If the company could achieve its goals in “priority” markets like Japan, it would provide “good reference points to other countries,” said the 2014 Philip Morris presentation on reduced-risk products like iQOS.

It unveiled the device in an unlikely venue – Nagoya, a city of more than 2 million people on a bay of the Pacific Ocean. Nagoya is close to Toyota Motor Corp’s headquarters, a town of skyscrapers and automotive plants; a place with neither the buzz of Tokyo nor the charm of Kyoto.

Philip Morris pushed ahead with a national expansion in September 2015. In an in-house newsletter for the Japan operations the next month, Ashok Rammohan, director of reduced-risk products, told employees that “building iQOS will take time and focus as we need to educate LAS” – legal-age smokers.

By early 2016, the buzz surrounding iQOS in Japan was growing, thanks in part to a group of Japanese entertainers. That April, six popular Japanese comedians were on a national TV show when the presenters began to talk about smoking. One of the comedians, Terumoto Goto, a household name, held up a red iQOS.

“It doesn’t release smoke,” he explained. “It’s like steam coming out of my mouth.” The five men sitting around him on the TV set, decorated with bright rainbow stripes, held up iQOS units as well.

Goto said he bought an iQOS because his wife wouldn’t let him smoke cigarettes inside their house and the neighbors didn’t like him standing around and smoking outside.

Toshiyuki Itakura, just behind Goto, chimed in about smoking the device in public: “There doesn’t seem to be any harm.”

Searches on Google for the Japanese word for iQOS spiked that day.

The talent agency that represents Goto and Itakura, Yoshimoto Kogyo Co Ltd, said in a statement: “Our company received absolutely no payment from Philip Morris or affiliated companies” for the appearance. The network that carried the show, TV Asahi Corp, said it did not consult with the tobacco company beforehand.

That promotional bump came during a period when Philip Morris was working to use social media to propel iQOS into the national consciousness.

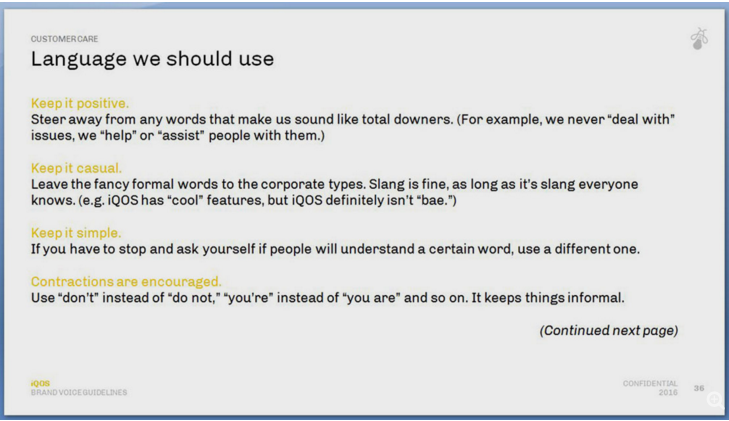

“That IQOS moment.” “My IQOS way of living.” Those are two of the catchphrases the company’s social media team considered using as catalysts to promote online chatter about the device. The guidance appears in a 2017 online-content strategy paper, marked “confidential,” that cites examples from Japan.

A separate document, a 54-page training handbook for social media teams in 2016, warns that the company’s postings walk a fine line. “Since the law is set up to prevent tobacco companies from promoting their products on social media, and iQOS is a product that uses tobacco, you’ll always be walking through a minefield of sorts,” the document says.

Away from the public eye, Philip Morris employees equipped with pages of scientific findings were lobbying government officials in Japan. They set out to convince regulators to tax iQOS at a lower rate than cigarettes and exempt it from ordinances that ban smoking in public places and restaurants.

Koki Okamoto, a member of the Tokyo Metropolitan Assembly, said the city’s planned public smoking regulations almost certainly will exempt iQOS. “My personal view, as a lawyer, is that there will be reluctance to apply penalties to something without scientific evidence on health hazards,” said Okamoto, a lead for tobacco control issues in the party that won the capital’s elections this July.

To date, Philip Morris is responsible for the majority of the science that has been published about iQOS.

Philip Morris executives say the product is meant only for people who would not otherwise quit smoking. That is inconsistent with where the company has chosen to introduce iQOS.

Industry sales numbers show Philip Morris is selling iQOS almost entirely in countries where cigarette sales are already in decline – in other words, where people are quitting. While the global average for cigarette sales was down 1.9 percent from 2005 to 2016, in 30 countries where iQOS is now sold the drop in sales was about 30 percent, according to a Reuters analysis of industry numbers from Euromonitor International.

Philip Morris said in response that there are more than 180 million smokers in the countries where iQOS has been launched. “Those 180 million people deserve an opportunity to switch to a potentially less harmful product than cigarettes,” the company said.

As the company honed its strategy in Japan – impressing officials with its scientific findings while advocating for lower taxes – it set out to conquer new markets.

More than half a year before iQOS launched in Israel, Moira Gilchrist, a corporate affairs vice president for reduced-risk products, flew into the Holy Land and took a March 2016 meeting with a senior health ministry official to talk about the company’s science.

A few weeks after that meeting, the official, Itamar Grotto, sent a letter to the country’s tax authority saying iQOS was in a new product category exempt from marketing and advertising restrictions on tobacco products. In a later court filing, Philip Morris cited the letter in explaining its decision to launch iQOS in Israel.

Asked why he said iQOS was exempt from tobacco regulations, Grotto told Reuters that the ministry was being cautious after losing a case against e-cigarette companies a few years earlier. Grotto also said he thought at the time that the question of regulating iQOS was “theoretical.” He had understood from Philip Morris that it did not plan to market the device in Israel until it had approval from a European or American regulatory authority, Grotto said.

Told of Grotto’s remarks, Philip Morris said in a statement, “We did not state that PMI would wait for the approval of a foreign regulatory authority.”

In Israel, iQOS has faced obstacles. This March, a group headed by an activist named Shabi Gatenio challenged the health ministry and Philip Morris in the country’s top court over the sale of iQOS without the same marketing restrictions imposed on regular cigarettes. An Israeli tobacco company also challenged the government and Philip Morris in a similar filing.

During an interview in Tel Aviv, Gatenio, 45, marveled at the reach and access of Philip Morris. He said within two and half hours of his filing the court petition, before it had become public, he got a text message from Erez Gil-Har, co-chief executive of Policy Ltd, Philip Morris’ powerful lobbying company in Israel. The message, viewed by Reuters, accused Gatenio of becoming a “tool” in the hands of the local tobacco company – a charge he dismisses.

Gil-Har, who attended the meeting with Grotto and Philip Morris’ Gilchrist, declined to comment. The tobacco company, Dubek Ltd, declined to talk as well.

Before the court could give a final ruling, the health ministry reversed its position and said it would treat iQOS as it does traditional cigarettes. The ministry said it planned to revisit its decision after seeing how the U.S. FDA regulates the product.

The about-turn left Philip Morris scrambling. According to a government official familiar with the matter, Philip Morris hired more than two dozen women for an urgent task: They manually peeled off the old labels from thousands of tobacco-insert packs in a warehouse near Tel Aviv and stuck on new ones with more prominent health warnings. The packs were then released.

Half a world away in Colombia, Philip Morris kicked off its sale of iQOS this March with a large white balloon at a music festival. Emblazoned with “iQOS” in blue and green letters, the balloon was hoisted 20 feet in the air by a crane.

Tobacco advertising and promotion are banned in Colombia, the first country in Latin America to get iQOS. According to a health ministry official, Philip Morris launched iQOS without getting approval from the agency to sell the tobacco inserts in the country as is required by law.

“This is a product which is derived from tobacco and which must have a prior evaluation by this ministry,” said senior health ministry official Jose Fernando Valderrama.

Philip Morris said it is in compliance with Colombian law. The company said it is required to submit the tobacco inserts for health ministry approval following the release of the agency’s tobacco warnings in November each year. Its Colombian affiliate will do so “in the next month,” the company said in a Dec. 7 statement to Reuters.

On a stroll through the capital Bogota a few months ago, iQOS could be seen being sold at the front of a restaurant with bright displays of packs of the tobacco inserts and the hummingbird emblem facing the sidewalk. In a trendy quarter of the city, a large white billboard advertised a coming “iQOS Boutique,” next to a Starbucks and an Apple retailer.

A former Philip Morris employee in Bogota said the company’s position is that because the device itself does not include tobacco, unlike the inserts, marketing restrictions don’t apply to it.

The company confirmed that position, saying iQOS is an electronic device, and “as such, the current tobacco law does not regulate its commercialization as a tobacco product.”

Back in Japan, sales of the device have taken off. Philip Morris says the iQOS tobacco inserts made up 11.9 percent of the Japanese tobacco market in the third quarter, up from 3.5 percent a year ago.

That growth took on additional significance for company revenue in light of the lower tax rates. The iQOS kit retails for about 11,000 Japanese yen, roughly $100. The company said that cigarettes in Japan are taxed at 60 percent, while the iQOS tobacco inserts – priced about the same as a pack of Marlboros – are at 51 percent.

Philip Morris shows no signs of slowing down. Paul Riley, president of the company’s operations in Japan, this January called on Emiko Takagai, who as a former vice health minister is an influential voice on national health policy. They met in Takagai’s seventh-floor office in Tokyo, one decorated with stuffed animals and posters of healthy food groups.

During that conversation, Riley laid out the company’s pitch on iQOS, said Takagai. In documents later sent to her office, Philip Morris said the product reduces the levels of harmful substances by at least 90 percent compared to regular cigarettes.

When Reuters in August interviewed Takagai, a member of the upper house of parliament for the nation’s ruling party, it seemed the tobacco giant’s message was hitting home.

If the company’s scientific claims bear out, she said, “we must make efforts to thoroughly tell people.”