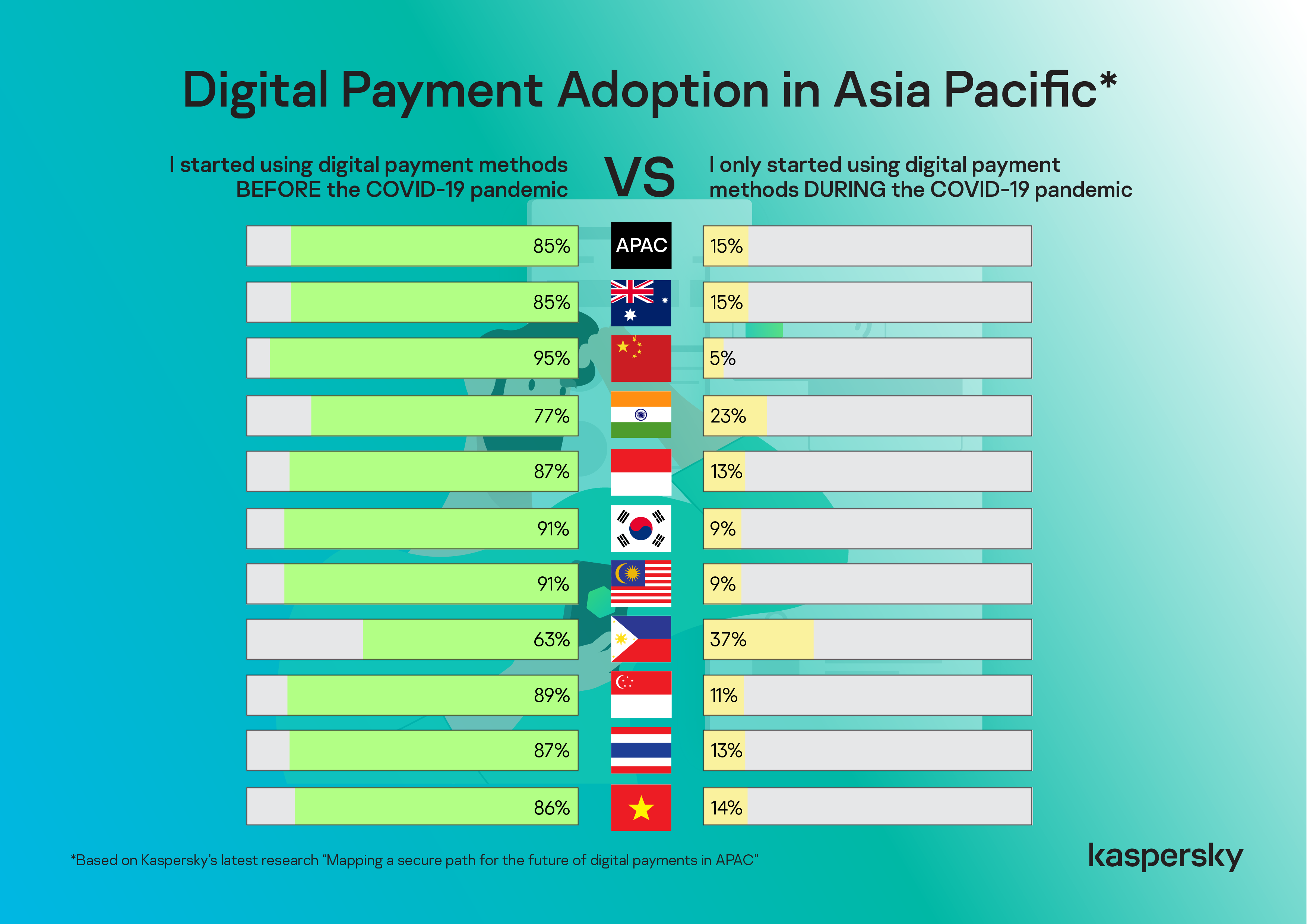

The Philippines has the highest number of new users of e-cash or mobile payment apps across countries in Asia and the Pacific during the pandemic, according to a cybersecurity firm.

Based on data gathered by Kaspersky, the country has 37% first-time e-cash adopters in the past 12 months or when the COVID-19 pandemic struck.

It was also around that time when the national government also implemented tough lockdowns where the outdoor movement was restricted.

The following countries followed the Philippines when it comes to number of new e-cash users:

- India (23%)

- Australia (15%)

- Vietnam (14%)

- Indonesia (13%)

- Thailand (13%)

- South Korea (9%) and Malaysia (9%)

- China (5%)

The results were based on those who agreed with the statement: “I only started using digital payment methods during the COVID-19 pandemic.”

The other statement in the choice was “I started using digital payment methods before the COVID-19 pandemic.”

Here is a comparison of answers in Asia Pacific countries:

Overall, Kaspersky data found that the majority of their Asian respondents or 90% started to use mobile payment apps at least once in the past year.

These findings, therefore, showed that digital payment methods may soon replace cash for day-to-day transactions in APAC.

“Data from our fresh research showed that cash is still king, at least for now, in APAC with 70% of the respondents still using physical notes for their day-to-day transactions. However, mobile payment and mobile banking applications are not far behind with 58% and 52% users utilizing these platforms at least once a week up to more than once a day for their finance-related tasks,” said Chris Connell, Managing Director for Asia Pacific at Kaspersky.

“From these solid statistics, we can infer that the pandemic has triggered more people to dip their toes into the digital economy, which may fully dethrone cash use here in the next three to five years,” Connell added.

Fears of first-time users

Kaspersky also asked first-time e-cash users about their fears or reservations about going digital.

Results showed that the fear of losing money online is the source of worry of most respondents or 48% of them.

This is followed by the fear of storing their financial data online, according to 41% of respondents.

Nearly four in ten respondents also have trust issues in the security of online payment platforms.

More than a quarter or 26% find the technology too troublesome, citing the requirement of passwords and questions.

The other 25% of respondents viewed their devices might not be secure enough.

“It is a welcome finding that the public is aware of the risks that comes with online transactions and because of this, developers and providers of mobile payment applications should now look into the cybersecurity gaps in each stage of the payment process, and implement security features, or even a secure-by-design approach to fully gain the trust of the future and existing digital payment adopters,” Connell said.

This data came from the research titled “Mapping a secure path for the future of digital payments in APAC” where regional users’ interactions with available online payment firms were examined.

This report was conducted by research agency YouGov in 10 countries in APAC. These are Australia, China, India, Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand and Vietnam.

Survey responses were gathered in July 2021 with 1,618 respondents across the region.

The respondents are aged 18 to 65 years old working professionals who use online payment in their transactions.

This report is also part of Kaspersky’s 7th Cybersecurity Weekend with the theme “Marking the money movement in APAC” that took place last October 14.