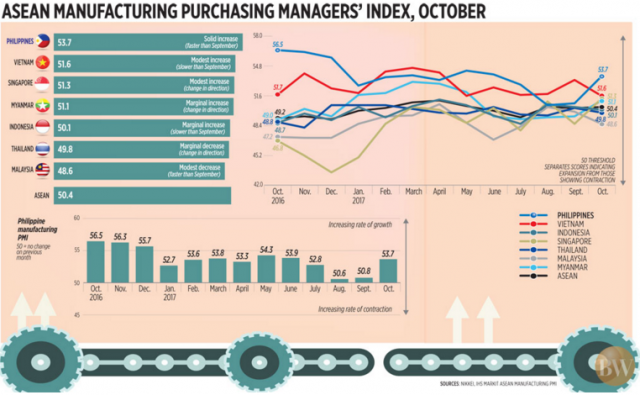

MANILA – The Philippines in October wrested from Vietnam the lead in Southeast Asia manufacturing activity that the former lost back in February, as local businesses began 2017’s last quarter with anticipation of greater demand at home, according to monthly tracking done by IHS Markit for Nikkei, Inc.

The seasonally adjusted Nikkei Philippines Manufacturing Purchasing Managers’ Index (PMI) increased to 53.7 in October from September’s 50.8, “signalling a marked pickup in the pace of improvement in operating conditions.”

“The latest reading was also well above the third quarter average,” the Philippine report read.

The manufacturing PMI consists of five sub-indices, with new orders having the biggest weight at 30%, followed by output (25%), employment (20%), suppliers’ delivery times (15%) and stocks of purchases (10%).

October data were compiled from replies to questionnaires sent to purchasing executives of 350 industrial companies.

A PMI reading above 50 suggests improvement in business conditions from the preceding month, while a score below that signals deterioration.

“The Philippines manufacturing economy showed greater signs of activity at the start of the fourth quarter, expanding at a solid pace in October,” the report read.

“Growth in both output and new orders picked up noticeably, prompting firms to step up input purchases and hiring,” it added.

“Anticipating greater demand, companies also built up stocks of inputs and finished goods, while increased staff numbers helped them keep on top of workloads.”

The fourth quarter usually sees a pickup in household consumption — which fuels more than three-fifths of the country’s economy — as the Christmas holidays approach.

“Signs of strengthening demand emerged in October,” the report read, noting that “order book growth accelerated to a five- month high, following a trend of slower expansions.”

To be sure, growth of export sales “remained moderate, leaving domestic demand as the key source of growth.”

“Overseas demand for Philippines’ products was up for a second straight month during October,” the report noted, adding that “[t]he rate of increase accelerated to the highest for four months but was modest overall.”

After falling in the preceding two months, employment in the Philippines’ manufacturing sector rose at the start of the fourth quarter in the face of increased production requirements.

Business confidence “remained elevated” even as optimism slipped to the lowest level since the Philippine survey began in January 2016.

At the same time, “[s]trengthening client demand was accompanied by growing inflationary pressures,” fueled primarily by the peso’s overall depreciation. The local currency has been plumbing 11-year lows lately.

“Cost increases were sharp, rising at the fastest rate since March as imported materials, such as paper, fuel and industrial metals, became more expensive,” the report read.

“To protect their margins, firms hiked selling prices to the greatest extent in the survey history.”

Bernard Aw, principal economist at IHS Markit, noted in the same report that “[a]fter two months of marginal growth, there was a flurry of activity in the Philippines manufacturing sector at the start of the fourth quarter.”

“Demand for Filipino manufactured goods strengthened noticeably, with order book growth picking up to a five-month high. Greater demand lifted production volumes, which in turn prompted firms to hire more workers,” he explained.

“Further weakening of the peso poses a problem for manufacturers, especially those that rely on imported inputs for production. Input cost inflation picked up sharply, which led firms to raise prices in order to preserve profit margins,” he noted.

“Charges for Filipino goods increased at the fastest rate on record. This signals that inflationary pressures are building in the Philippines, suggesting that consumer inflation may trend above BSP’s (Bangko Sentral ng Pilipinas) inflation expectations.”

This, in turn, “will compel the central bank to consider tightening monetary policy as early as this year” after keeping it steady since September 2014, save for procedural tweaks in June last year as the central bank put in place an interest rate corridor system designed to better mop up excess liquidity and influence market rates.

Sought for comment, Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, described the latest PMI results as “encouraging”.

“In spite of the peso’s weakness, manufacturing in the country continuous to grow,” Mr. Asuncion said in an e-mail, noting that the country depends heavily on imports of production inputs and capital goods. “This increasing production demand comes from the robust growth in consumption that forms most of the country’s GDP…”

The Philippines’ 53.7 reading in October compared to the 50.4 of the seven Association of Southeast Asian Nations (ASEAN) members surveyed.

Three other ASEAN members did better than the group as a whole, namely: Vietnam (51.6), Singapore (51.3) and Myanmar (51.1).

Indonesia logged a “stagnant” 50.1, while Thailand and Malaysia registered 49.8 and 48.6, respectively, which signalled contraction.

“The Philippines overtook Vietnam to lead the overall growth rankings, with its PMI picking up to a four-month high during October,” the ASEAN report read. “Vietnam slipped to second position as its rate of growth slowed to the weakest since May.”

CAPTION: Bernard Aw, principal economist at IHS Markit: “Further weakening of the peso poses a problem for manufacturers, especially those that rely on imported inputs for production.”