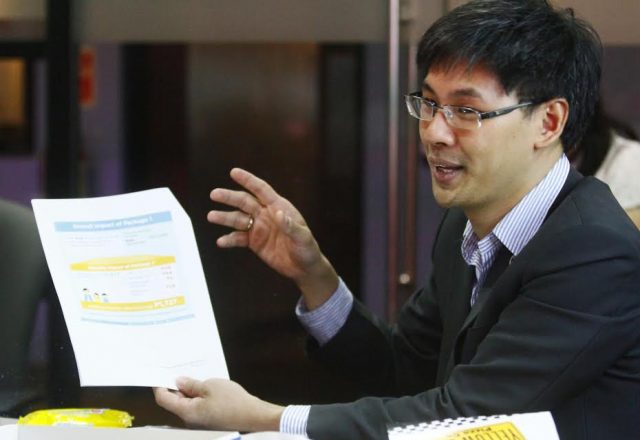

MANILA – The tax reform package that the Executive is prodding Congress to pass is not so much about merely taxing people but “about investing in our country’s future,” said a Finance department official who has been explaining the measure to lawmakers and stakeholders.

Undersecretary Karl Kendrick Chua said that, unlike previous tax reforms meant to “raise revenues to pay our debts or to plug the deficit,” the Duterte administration-championed package embodies a combination of fund raisers for an ambitious infrastructure buildup to support socioeconomic growth goals, as well as significant provisions for empowering people like lower personal income taxes.

A super-majority of President Duterte’s allies in the House of Representatives, taking their cue when the President certified the bill as urgent, had passed the TRAIN – for Tax Reform for Acceleration and Inclusion – on May 31.

From here on, Senate hearings will continue through to September, starting July 24 when sessions resume.

The DOF is pushing to get the bill in place by Jan. 1, 2018, Chua said in a recent briefing at the News5 Media Center.

“Then the President can sign in October and we need one month for IRR [implementing rules and regulations], and one month for publication, because we want this tax reform to be implemented by January 1. That’s basically the timeline we’re looking at,” said Chua.

Taxes on fuel, cars, beverages

The tax reform program will slash personal income taxes, sparing 83% of Filipinos from paying it, but will lose the government P140 billion in revenues in the process.

To make up for that, the measure will also impose excise taxes on fuel, automobiles, and even sugar-sweetened beverages, which will bring in P133.8 billion or about 0.8 of the GDP in 2018.

However, the Finance department stresses, tax reform is an anti-poverty and anti-inequality measure, and not a revenue-generating tool to help a cash-strapped government.

“This tax reform is really about investing in our country’s future. It’s not a tax reform so that we can raise revenues to pay our debts or to plug the deficit. That was the tax reform in 2005, the VAT reform. [In truth], we don’t need a tax reform today if the sole reason is to raise revenues because we’re doing great as a country, our macroeconomic [performance] is very solid,” Chua pointed out.

In President Duterte’s letter to Senate President Koko Pimentel and Speaker Pantaleon Alvarez to certify the tax reform bill as urgent, he noted: “The benefits to be derived from this tax reform measure will sustainably finance the government’s envisioned massive investments in infrastructure, thereby encouraging economic activity and job creation, as well as fund the desired increase in the public budget for health, education and social programs to alleviate poverty.”

Instead,the administration said, the fiscal space created from the new taxes will be spent largely on massive investments in infrastructure to spur economic activity and create jobs, as well as in funding public education and health.

All the money, Chua said, “will only be used for five purposes and it’s in the bill – infra, education, health, social protection and housing.”

P8.4-trillion infra plan

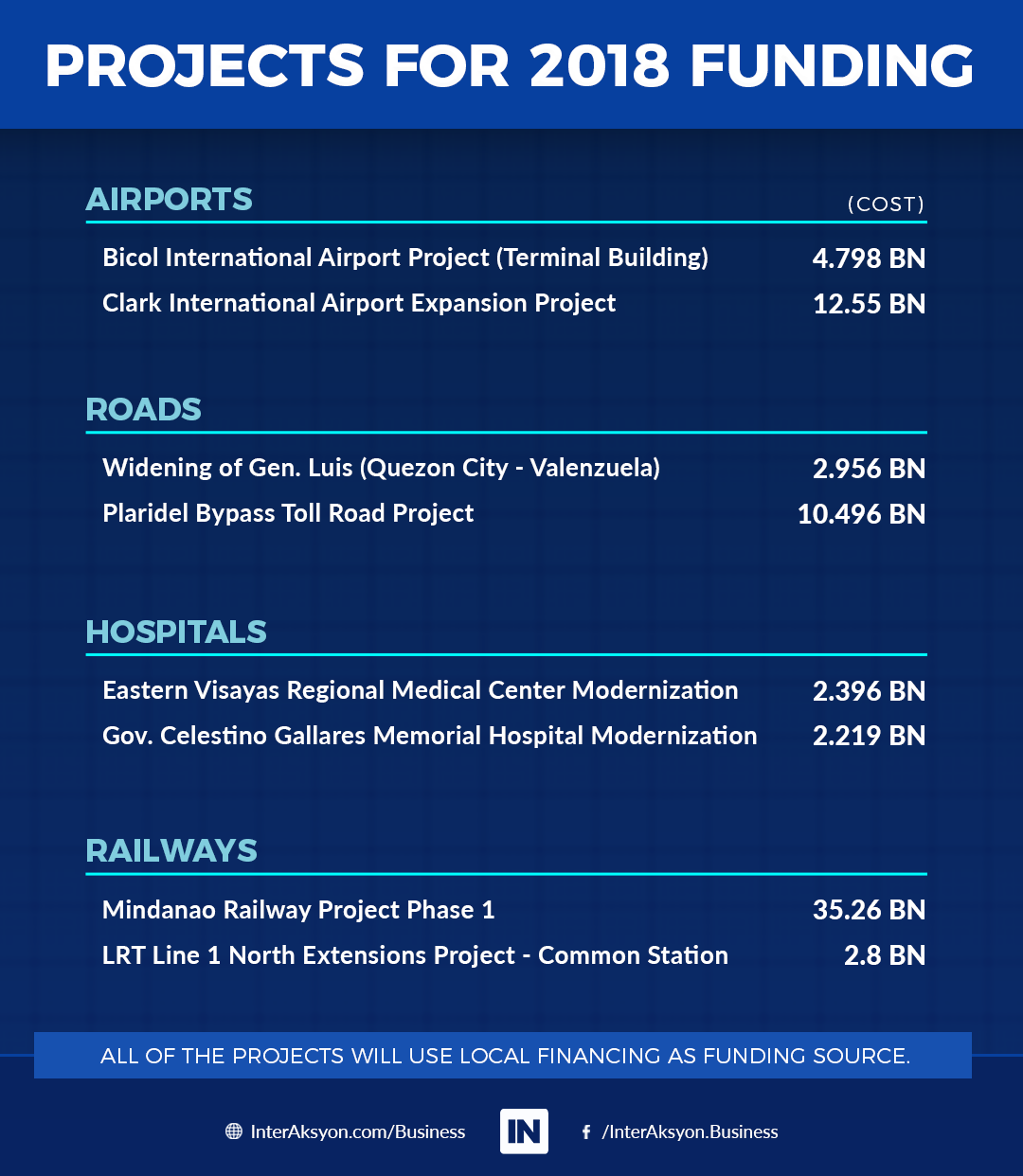

Duterte is embarking on an ambitious infrastructure plan with an P8.4-trillion price tag.

Among the projects already greenlighted, some P73 billion will be coursed either through local financing, the national budget or domestic borrowing.

Chua pointed out that it’s also fallen on this government to bankroll the K to 12 program as well as the universal healthcare package legislated under the previous administration.

“The problem that time is, they didn’t realize that it has to be funded massively, [since] you need more than 200,000 new teachers and 100,000 new classrooms. So we will fund that, so the teachers are not tired; [so that] the students [are] not cramped in hot classrooms so that their learning capacity can be improved,” said Chua.

He noted one problem: even if there is universal healthcare, if the hospitals are substandard, or if 16,000 of the barangays are without health centers, even if you have universal health care [if you don’t have] supplies or doctors, [that’s still not enough]. So we are going to fund that with the tax reform.”

Beyond this, he said the Duterte team also needs to crack down on tax evaders and prove they’re not afraid of going after big fish.

In short, the whole 10-point socioeconomic agenda of the Duterte administration is anchored on how effectively the tax reform plan is carried out.

And that’s a legacy the 16th president of the Republic can’t afford to gamble away.