MANILA – Overall price increases quickened further in September at the fastest clip in five months due to higher food and oil costs, even as the pace is not enough to unsettle current monetary policy, the government reported Thursday.

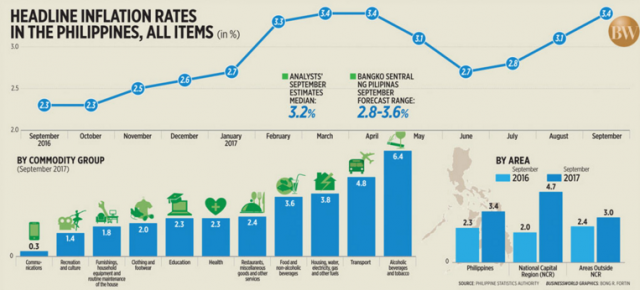

The Philippine Statistics Authority (PSA) reported that prices of widely used goods and services increased by 3.4% last month, jumping from 3.1% in August and the 2.3% logged a year ago.

The actual pace matched the Finance department’s estimate and compared to the 2.8-3.6% forecast range given by the Bangko Sentral ng Pilipinas (BSP) and a 3.2% median in BusinessWorld’s poll late last week.

Year-to-date, headline inflation has averaged 3.1% against the BSP’s 3.2% forecast and 2-4% target range for full-year 2017.

Excluding select food and energy items susceptible to volatile price swings, core inflation clocked 3.3% last month — against August’s 3.0% and September 2016’s 2.3% — and 2.9% in the nine months to September, the PSA added.

September’s headline pace matched that of March and April and was the fastest since November 2014’s 3.7%.

BSP SIGNALS POLICY STABILITY

Despite the faster-than-expected overall pickup in prices, the central bank sees no need to tweak policy interest rates currently anchored on a 3.0% overnight reverse repurchase rate.

“The BSP remains of the view that the inflation environment will continue to be manageable over the policy horizon after taking into account the latest assessment of price levels in September,” BSP Governor Nestor A. Espenilla, Jr. said in a statement, noting that monetary authorities still expect annual inflation to settle within the 2-4% target band from 2017 to 2019.

“Firm domestic economic activity, sufficient liquidity and well-anchored inflation expectations continue to support current policy settings.”

Food inflation increased by 3.7% last month, roughly the same rate observed in August but higher than September 2016’s 3.1%. “Faster price increases were recorded for corn, fish, vegetables, cereals, flour, bread, pasta and oils and fats,” the National Economic and Development Authority (NEDA) noted in a statement.

“The accelerated adjustments in food — particularly corn, fish, and vegetables — can be partly traced to the lingering effects of Typhoon Jolina and Tropical Depression Maring, which caused damage to agriculture and fisheries in the CALABARZON region, particularly Quezon province,” Socioeconomic Planning Secretary Ernesto M. Pernia said in the statement from NEDA, which he heads as director-general.

Increases were likewise seen in other commodity groups, namely: alcoholic beverages and tobacco (6.4% from August’s 6.3%); clothing and footwear (2.0% from 1.9%); housing, water, electricity, gas and other fuels (3.8% from 2.8%); transport (4.8% from 4.4%); as well as restaurant and miscellaneous goods and services (2.4% from 2.2%).

Angelo B. Taningco, economist at Security Bank Corp. pinned the inflation results on price hikes in electricity and petroleum products.

Guian Angelo S. Dumalagan, market economist at the Land Bank of the Philippines, likewise said “[t]he rise in oil prices is one of the primary contributors to last month’s inflation.”

“Higher oil costs affect many items in the consumer basket, as crude oil is an input to production,” he said.

“Furthermore, the impact of heavy rains might be more pronounced than expected, leading to a higher increase in food prices.”

Power distributor Manila Electric Co. announced early last month that its overall rate would increase by P0.8642 per kilowatt hour (/kWh) to P9.2491/kWh from August’s P8.3849/kWh.

Likewise, fuel retailers had announced a series of price increases for both gasoline and diesel to reflect movements in international markets.

For Ruben Carlo O. Asuncion: “There seem to be a weak pass-through relation between domestic food prices and the weak peso.”

“I say this because it seems more apparent that the food and non-alcoholic beverages index was largely impacted by oil prices and weather shocks,” he said.

“The peso has been weak for most of this year, but still inflation levels have been modest and within the government’s target,” he explained.

Mr. Asuncion expects inflation in the fourth quarter to be “manageable moving forward” at 3.0-3.5%, while Security Bank’s Mr. Taningco gave a three percent fourth-quarter inflation estimate.

For Landbank’s Mr. Dumalagan, inflation “could remain above 3.1%” in the last three months of the year with the peso expected to depreciate further as the US Federal Reserve is now widely expected to hike interest rates further by December.

“The slow and steady rise in oil costs might also continue to boost consumer prices,” he said.

NEDA’s Mr. Pernia expressed optimism that inflation will settle within the official 2-4% target for the year, even as risks like even higher fuel prices, an even weaker peso and the P21 daily minimum wage hike for Metro Manila’s private sector workers that took effect yesterday weigh on his outlook.

ALL BETS OFF ON RATE HIKE

Analysts at Nomura Global Research said the latest inflation print should leave room for the central bank to keep policy rates steady for the rest of the year, with two rate hikes expected in the second half of 2018.

Economists at ANZ Research said tighter credit conditions will be “necessary” in the first quarter of next year, with rising inflation adding to the impact of elevated credit growth, excessive activity in real estate and deterioration of the country’s current account.

For Jose Mario I. Cuyegkeng, senior economist at ING Bank N.V. Manila, the BSP might need to introduce a “pre-emptive” tightening by December to douse potential overheating in the local economy.