MANILA – Inflation could have picked up in October amid rising fuel, utility, and food prices to possibly hit a three-year high, according to a BusinessWorld poll of analysts, who said the Bangko Sentral ng Pilipinas (BSP) will likely keep borrowing rates steady as estimates remain within target.

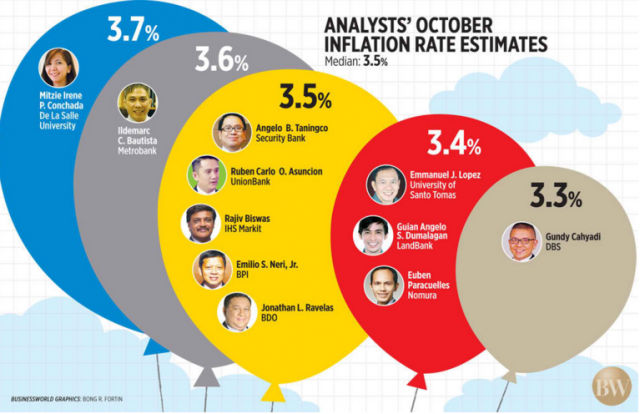

A poll among 11 economists yielded a 3.5% median estimate for the month which — if realized — would pick up from September’s 3.4% and the 2.3% reading a year ago, and would be the fastest since November 2014’s 3.7%. It likewise falls within the 3.2-3.7% estimate range given by the central bank last week.

The Philippine Statistics Authority is scheduled to report October inflation data on Tuesday.

“I think the main drivers of inflation in October were food price inflation, higher transport costs, upticks in electricity rates and petroleum product prices, and the minimum wage hike in the NCR (National Capital Region),” Angelo B. Taningco, economist at Security Bank Corp., said in an e-mail interview.

Fuel pump prices rose in October to mirror higher world crude prices, while electricity and water concessionaires introduced higher charges that took effect last month.

At the same time, a P21 increase in the daily minimum wage for Metro Manila’s private sector workers took effect on Oct. 5, which in turn is expected to have forced many businesses to jack up prices in order to cover the higher manpower cost.

Other analysts cited the impact of the depreciation of the peso against the dollar, which averaged at P51.3433 for the month and touched a fresh 11-year-low at P51.77.

“The impact of the weak peso may be muted at this point with domestic demand continuing to grow. However, the pass-through effect of currency depreciation on the level of prices should not be discounted,” said Ruben Carlo

O. Asuncion, chief economist at Union Bank of the Philippines, Inc.

Inflation averaged 3.1% in the nine months to September, which is a notch below the central bank’s 3.2% forecast average for the entire year.

Economists widely believe that inflation should settle within the 2-4% target band set by the BSP for 2017, even as they see an accelerating pace of price increases in 2017’s remaining months.

“At any rate, we don’t believe the BSP will be hiking policy rates yet as inflation expectations continue to be benign, with the inflation numbers well within the BSP band even while being on an upward trend,” said Ildemarc C. Bautista, vice-president and head of research at Metropolitan Bank & Trust Co.

The BSP’s policy-setting Monetary Board will review interest rate settings on Thursday, which comes a week after the United States Federal Reserve opted to keep rates steady as monetary authorities there dropped hints that they remain on track to a fresh rate hike — the third for the year — in December.

US President Donald J. Trump has nominated Fed Governor Jerome H. Powell as the next central bank chief, which has supported the recovery of the peso over the past few days as the market viewed him as a “dovish” candidate.

Mr. Powell will succeed incumbent Fed chair Janet L. Yellen whose term ends in February.

Three economists, however, did not dismiss the possibility of a BSP rate hike by yearend. “The possible stabilization of domestic inflation at 3.4% is supportive of steady BSP policy rates this month, although expectations of another US interest rate hike in December 2017 keep open the chances that the BSP would follow its US counterpart,” said Guian Angelo S. Dumalagan, market economist at Land Bank of the Philippines.

DBS Bank economist Gundy Cahyadi said a 25-basis-point hike could be in the cards this week, since the BSP may have to catch up with rising inflation and a weaker peso, which has led to “slower investment growth.”

The BSP has kept its policy stance steady in the last three years, except for procedural adjustments in June 2016 for the migration to an interest rate corridor system.