MANILA — The Philippines risks losing its investment grade rating if it fails to reform an “unsustainable” military and uniformed personnel (MUP) pension system because it will constrain its ability to cut its debt and deficit, the finance secretary said.

President Ferdinand Marcos Jr has made reforming the retirement system for service personnel a priority as his government seeks to consolidate its finances and free up resources to fund much-need infrastructure.

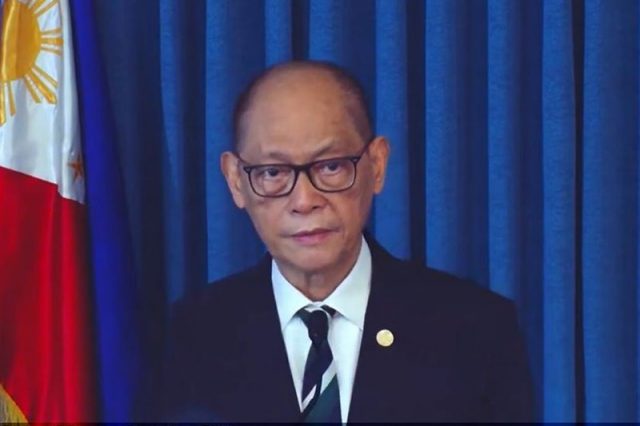

The Philippines could see its investment-grade rating, which it has held for a decade, relegated to “junk” territory if “we continue to ignore” the need to reform the MUP system, Finance Secretary Benjamin Diokno told senators on Wednesday in a budget hearing.

Fitch Ratings has Philippine sovereign bonds at BBB, with a stable outlook; Moody’s Investors Services has them at Baa2 and S&P Global Ratings at BBB+ both with stable outlooks.

Troops and uniformed personnel, who include police and prison staff, are not required to contribute to their pensions under the current retirement system, with funding solely coming from the government budget.

Diokno has been pushing for changes, including making contributions mandatory, to speed up fiscal consolidation with the aim of slashing the government deficit to 3.0 % of gross domestic product (GDP) and debt to 51.1% of GDP by 2028, from 6.1% and 61% this year, respectively.

Changes to the MUP pension system requires legislation.

Currently, 214 billion pesos ($3.8 billion), equivalent to 0.9% of GDP, is needed to pay for MUP pensions and the government has forecast the sum will increase to 537 billion pesos by 2030, and to 1.5 trillion pesos by 2040.

“The pension system is not a real pension system in the following sense – there are no contributors. A pension system is where the beneficiaries of the pension system contribute and there’s a government counterpart,” Diokno said.

The current set up, Diokno said, was “unsustainable” because it would become a “huge component of the national budget”.

($1 = 56.8000 Philippine pesos)

— Reporting by Karen Lema