Apart from the usual Monday morning blues were Uber users bidding farewell after receiving a notice from the ride-hailing company over the weekend announcing closure of its operations in the Philippines as part of its merger with Southeast Asia competitor Grab.

@Uber_PH I miss you na ??? pic.twitter.com/8Rv1e0SwQd

— Dianne Alejo (@dianne_alejo) April 16, 2018

Rest in Peace #Uber Philippines ?

You will be missed. #uberph #ubermanila pic.twitter.com/VZ0Jtc8Gf1— Dan Alpapara (@dan_MD) April 16, 2018

Price questions

Along with the collective grief for Uber’s exit is a slew of complaints about Grab’s expensive rates on the first day of its market dominance.

Grievances have been aired not just against the service itself but also against government transportation agencies.

Nagbbook ba ko sa CebuPac ha pic.twitter.com/mgRJuNkFEl

— Obli-Con Kenobi (@ye_naeuri) April 15, 2018

@LTFRB @SouthSnippets @alabangbulletin @city_pinas

Now that Uber is gone, @grabph is charging P651 for Times, Las Pinas to Buendia-Paseo, Makati. Say hello to more waiting time at UV Express terminals & jampacked buses. #Overcharged #CommuterProblems #GoodbyeUber #LateAgain pic.twitter.com/uRhAfzP3C2— Darvin Unisan (@djunisan) April 16, 2018

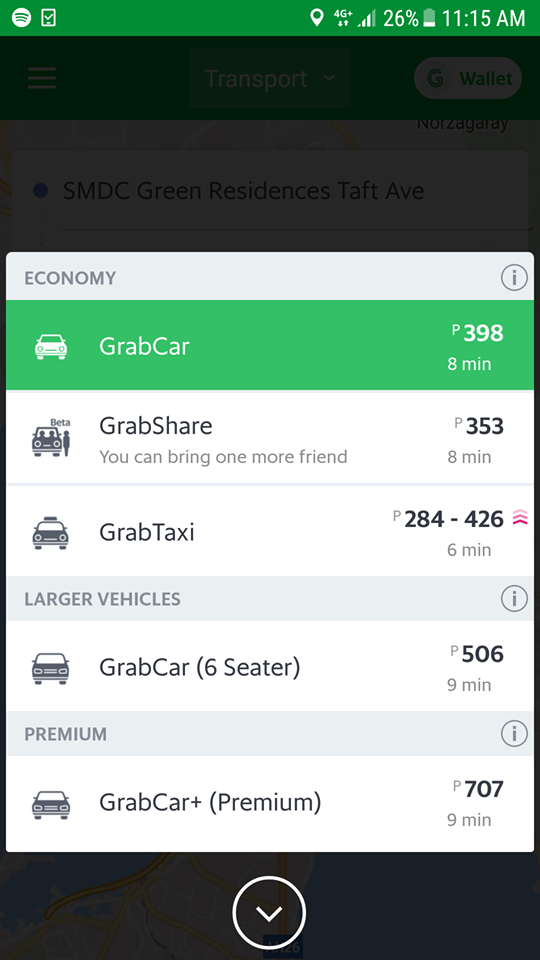

One user shared how a GrabCar booking from Manila to Quezon City costs P398 at around noontime.

The 20-kilometer journey from the condominium where he resides on Taft Avenue to a mall on Commonwealth Avenue in Quezon City would usually cost just around P250-P300 on Uber or a regular taxi, the rider argued.

UV express rides covering the same journey cost P45 a person.

Sen. Grace Poe, chair of the Senate public services committee, urged the ride-sharing company on Monday to “strike a balance that will not hurt the pocket of Grab riders but will not leave Grab drivers empty handed either.”

At a hearing last week, Grab defended its fare amid accusations that it was charging P2 per minute on top of government-approved rate computation.

The company also said the rates were caused by a low supply of drivers and high demand. Although its pool of drivers increased due to the Uber acquisition, booking requests also went up.

In late March, Grab Philippines head Brian Cu estimated that there would be less frequent surges in fares because of the increase in supply of cars across the map.

How Uber lost

Businessman and tech journalist Abe Olandres wrote that Uber’s submission to Grab was the logical development following Uber’s struggles in Southeast Asia.

“Uber’s approach of a one-size-fit-all wasn’t working well with the diverse cultural differences in the region. Grab had the cultural advantage and has been able to adapt to the various intricacies in each country it operates in,” Olandres wrote on The STAR.

He continued:

“Grab also has a more diverse offering, from a regular taxi cab to a car, van or a motorbike. It even offers express parcel delivery service via GrabExpress. Uber was only good at one category – car hailing and ride-sharing.

“In order for Uber to entice more riders into its fold, it had to match or exceed the promotions and incentives Grab was offering its drivers. This is one of the main reasons why Uber was losing money in its operations.”

Countdown to the exodus

Since Uber first announced the Singapore-bases Grab’s takeover its operations in Southeast Asia, users of both transportation network companies have noted the disparity in the rates —like this one and this one—offered by the two companies.

While announcing the merger, Grab Philippines’ chief Brian Cu said that fare calculation would not change.

Concerns raised by the Philippine Competition Commission while calling for Uber to continue its operations beyond the original takeover date of April 8 hinge on the consolidation of a near-monopoly of the transport network industry in the Philippines.

According to Grab, the merger of operations has resulted in Uber having a 27.5 percent stake in the merged company and Uber CEO Dara Khosrowshahi getting a seat on the Grab board.

Grab also announced that it would welcome the addition of Uber drivers into their roster.

Uber closures a complicated matter outside the Philippines

Regretful as many may be about Uber wrapping up in traffic-plagued Philippines, the Southeast Asia merger is only one of a handful of tie-ups Uber has inked in past two years.

US-based Uber has ceded its Russia operations to local giant Yandex-NV in 2017 and its China operations to counterpart Didi Chuxing in 2016. Both deals came during the tenure of former Uber CEO Travis Kalanick before his resignation.

But the deal has not proceeded smoothly elsewhere in the region.

A recent report by Tech In Asia reveals how many foresee the merger in Singapore to be pushed back, with the deal still under scrutiny by Singaporean competition watchdog, the Competition and Consumer Commission of Singapore.

Singapore has also ordered the Grab takeover to be delayed to May 7, almost a month after Grab’s takeover in Manila.

The CCCS cited a possible violation of Section 54 of Singapore’ Competition Act as grounds for its investigation into the matter. It also ruled that there must be no change in fare rate following the merger.