MANILA – Remittances hit a five-month high in August, according to data the Bangko Sentral ng Pilipinas (BSP) released Monday, shoring up expectations that household consumption continued to be a key driver of economic growth last quarter.

The government is scheduled to report third-quarter gross domestic product (GDP) data on Nov. 16. Household consumption accounts for more than three-fifths of GDP, which grew by 6.4% last semester against the government’s 6.5-7.5% full-year forecast.

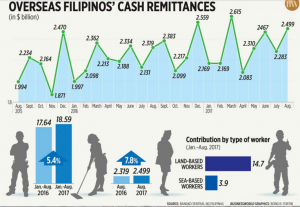

Money sent home by Filipinos abroad reached $2.499 billion in August, up by 7.8% from the $2.319 billion remitted a year ago, the central bank said in a statement. The monthly inflow picked up from July’s $2.283 billion, and is the biggest since the record-high $2.615 billion recorded in March.

Increased remittances from Filipinos based in the United Arab Emirates (UAE), United States, Singapore and Qatar drove the rapid rise in inflows, with both land-based and sea-based workers reporting bigger amounts that they sent to their families here.

The August figure brought year-to-date inflows to $18.595 billion, up by 5.4% from the $17.642 billion that entered the country during in 2016’s comparable eight months. The growth is faster than the four percent pickup expected by the BSP for the entire year.

STEADY DEMAND

BSP Deputy Governor Diwa C. Guinigundo said the steady demand for skilled Filipino laborers have been supporting the upbeat remittances story.

“We have stressed this before: skill sets are vastly different; new markets for Filipino skills have been found,” Mr.

Guinigundo said in a mobile phone message yesterday, adding that the additional inflows will help support the country’s current account and the peso.

With aging populations in advanced economies — including some in Asia like Japan — demand for Filipino labor has been sustained.

Security Bank Corp. economist Angelo B. Taningco noted that Filipinos abroad likely decided to send more cash back home, as their families are now able to squeeze more pesos out of the funds given the local currency’s depreciation.

The peso hit fresh 11-year-lows in August, weakening up to P51.49 against the greenback. The peso averaged P50.8747 per-dollar that month, coming from P46.6809 a year ago.

SUPPORTING THE ECONOMY

“I believe that such strong showing in OFW cash remittances bodes well for household consumption and economic growth for the third quarter,” Mr. Taningco said when sought for comment.

“I still expect OFW cash remittances to reach the $28 billion projection for the full year since I foresee its growth to sustain its accelerating trend for the remaining months of the year,” he added, noting that the Philippine economy is on track to keep full-year growth at 6.5%.

Economic managers believe growth will clock in faster this semester as more infrastructure projects go live, adding impetus already provided by upbeat household spending and investments.

The United States remained the biggest source of remittances totalling $6.167 billion, or roughly a third of inflows in the eight months to August. That was followed by the amounts sent home by Filipinos working in Saudi Arabia ($1.744 billion), UAE ($1.663 billion), Singapore ($1.16 billion), and Japan ($979.164 million).