MANILA – Foreign direct investments (FDI) pierced a full-year official target to hit “a record high” last year despite falling to a five-month low in December, the Bangko Sentral ng Pilipinas (BSP) reported on Monday, even as central bank data show bigger inflows elsewhere in Southeast Asia and a report of the Organization of Economic Cooperation and Development (OECD) called for reforms to attract more capital.

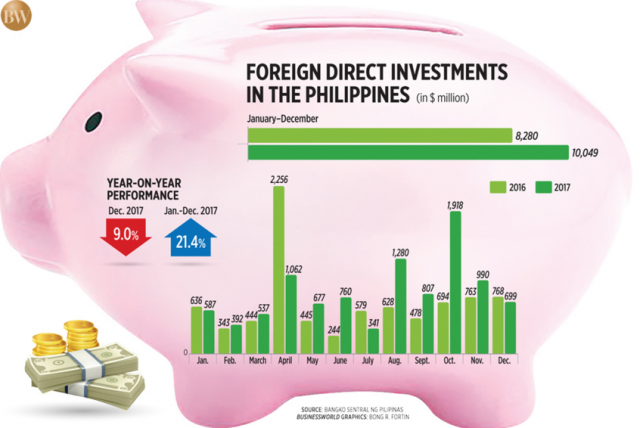

Net FDI inflows grew 21.4% to $10.049 billion last year from $8.28 billion in 2016 — past the central bank’s $8-billion full-year target that had already been pierced in the 11 months to November — as “investors continue to view the country as a favorable investment destination on the back of the country’s sound macroeconomic fundamentals and growth prospects,” the BSP said in a statement, noting that “[a]ll major FDI components registered increases during the year.”

INCREASE ACROSS FDI SEGMENTS

Data from the BSP bared double-digit growth rates for all components except reinvested earnings which nevertheless increased by 9.3% to $776 million from $710 million in the same comparative years.

Net equity capital — which excludes reinvested earnings — grew by 25.9% to $3.263 billion from $2.592 billion, as gross placements increased by 17.5% to $3.742 billion from $3.185 billion and withdrawals shrank by 19.3% to $479 million from 593 million.

“Equity capital placements originated largely from the Netherlands, Singapore, the United States, Japan and Hong Kong…” the BSP said in its statement, noting that “[b]y economic activity, equity capital placements were channeled mainly to gas, steam and air-conditioning supply; manufacturing; real estate; construction; and wholesale and retail trade activities.”

Lending by foreign parents to subsidiaries and affiliates in the Philippines increased by 20.7% to $6.01 billion last year from $4.977 billion.

December data, however, bared a mixed picture, with net FDI inflows slipping by nine percent to a five-month-low $699 million from $768 million a year ago and by 29.39% from November’s $990 million.

Net equity capital slipped by a nearly flat 0.4% to $305 million from $307 million in the same comparative months, as gross placements fell by 11.6% to $328 million from $371 million and withdrawals dropped by 65.3% to $22 million from $64 million.

The central bank said equity capital inflows came mainly from Singapore, Japan, the Netherlands, the United States and Luxembourg, going “largely” into manufacturing; real estate; wholesale and retail trade; information and communication; as well as arts, entertainment and recreation activities.

Intercompany lending similarly declined by 19.1% to $335 million from $414 million.

Only reinvested earnings climbed — by 24.1% to $59 million from $47 million.

The central bank’s FDI data covers actual investment inflows by parties with at least 10% foreign ownership, compared to investments tracked by investment promotion agencies that do not make use of this threshold and are mere commitments, the BSP explained in its Monday statement. The Philippine Statistics Authority reported in late-February that approved foreign investment pledges for the entire 2017 totaled P105.6 billion, down 51.8% year-on-year and the lowest amount since 2005’s P95.8 billion.

MOMENTUM

Attributing December 2017’s “slight decline… to high base/denominator effects a year ago amid new record highs in FDIs and in recent years/months,” Michael L. Ricafort economist at Rizal Commercial Banking Corp. (RCBC), said in an e-mail when asked for comment that “[t]he new record-high Philippine net foreign direct investments of $10 billion in 2017 — after the previous record high of $8.2 billion in 2016 — was brought about by the country’s improved economic and credit fundamentals amid the demographic sweet spot (i.e. majority of the country’s population of 105 million, the 12th biggest in the world, already part of the working age, thereby making the Philippines a more attractive market for FDIs), as well as the improved foreign relations of the Philippines with the US compared to more than a year ago and the relatively huge foreign investment pledges and official development assistance from Japan and China.”

Mr. Ricafort also noted that Fitch Ratings’ upgrade in December of the country’s sovereign debt score to a notch above investment grade “reflects improved international investor sentiment on the country amid the approval of the tax reform measures as well as the improved fiscal performance of the country due to improved government revenue/tax collections.”

He added that the weaker peso-dollar rate, compared to stronger currencies elsewhere in Asia, “may have helped increase FDIs into the Philippines” since this “made foreign investments into the Philippine cheaper compared to other ASEAN/Asian countries, assuming all other factors are constant/the same.”

Angelo B. Taningco, economist at Security Bank Corp. said in a separate e-mail that “the domestic economy’s positive growth momentum — supported by the central bank’s accommodative monetary policy and national government’s fiscal stimulus program — was instrumental in attracting record-high FDIs last year.”

COMPARISONS IN SOUTHEAST ASIA

Latest available central bank data, however, show some of the other Southeast Asian countries’ inflows eclipsing those of the Philippines.

The first three quarters already show Indonesia and Vietnam — the two countries to which the Philippines is closely compared — with $15.452 billion and $10.14 billion, respectively, outdoing the Philippines’ full-year tally.

The same three quarters saw Philippine net FDI inflows at $7.856 billion, against Thailand’s $6.248 billion and Malaysia’s $7.722 billion.

Singapore was a league of its own with $49.828 billion in 2017’s first three quarters.

A separate report the OECD released on Monday, titled: OECD Investment Policy Reviews: Southeast Asia, noted that while the Philippines, Malaysia and Thailand “have investment-related laws that date back decades,” Cambodia, Laos, Myanmar and Vietnam “have generally been active legislative reformers over time,” with “[e]ach iteration of the investment law… designed to address the weaknesses in the existing one.”

And while the Philippines has cut its corporate income tax rate by five percentage points since 2009, it still “stands out with an income tax rate significantly above the ASEAN average at 30%.”

MEASURES UNDER WAY

The current administration of President Rodrigo R. Duterte is now addressing that disadvantage with plans to reduce the corporate income tax rate gradually to 25% — still above the Association of Southeast Asian Nations’ (ASEAN) 23% average — by 2022 when the chief executive ends his six-year term.

It is also moving to lift foreign ownership restrictions in specific economic activities for which cumbersome amendment of the 1987 Constitution will not be needed to do so.

At the same time, however, the Duterte administration also aims to significantly slash tax incentives given to sectors where the government believes investors would have set up shop in the Philippines without such perks, as the

Finance department estimates foregone revenues from redundant perks at about P300 billion annually. Already, however, “Vietnam, the Philippines and Cambodia are the least generous” in providing income tax holidays, the OECD report noted, “providing a maximum… of four, six and six years of complete income tax exemption for qualifying investors.”

The BSP as of December last year — or before FDI data for 2017’s final three months were reported showing inflows closing in on and then breaching the full-year goal — had expected FDI net inflows in 2018 to hit $8.2 billion.

“Going forward, rollout/deployment of more infrastructure projects by the government amid increased revenue collections from the TRAIN of about P89.9 billion (70% of which allocated to infrastructure projects and the balance of 30% earmarked for social services) and further tax reform measures in the pipeline could further improve investor sentiment and encourage the entry of more FDIs into the country,” RCBC’s Mr. Ricafort said, referring to Republic Act No. 10963, or the Tax Reform for Acceleration and Inclusion (TRAIN) Act — the first of up to five planned tax reform packages, which took effect in January.

Security Bank’s Mr. Taningco believes that the FDI growth “momentum will continue this year on the back of potential continuation of the same monetary stance, stronger public infrastructure spending push and more tax reforms seen to make progress.”

“Likewise, there are now moves to ease foreign ownership and red tape — both of which would bode well for long-term foreign investments,” he said, projecting FDI net inflows this year at $9.5 billion. — with interviews by Elijah Joseph C. Tubayan