Now celebrating 20 years, the financial app GCash has been working continuously to present new features to make transactions seamless, faster, and more inclusive.

Whether paying bills, shopping, investing, or even getting insurance, this app puts financial power in your pocket.

“Can you imagine? Twenty years ago, Globe GCash imagined what the future would become… the idea for this app started with a simple sketch on a piece of tissue paper,” Neil Trinidad, chief marketing officer, said during its anniversary celebration on September 30.

“But here we are today. Then came the revolution, where GCash turned every smartphone into an e-wallet.”

Here are 20 user-fave features that have helped transform the way Filipinos manage money:

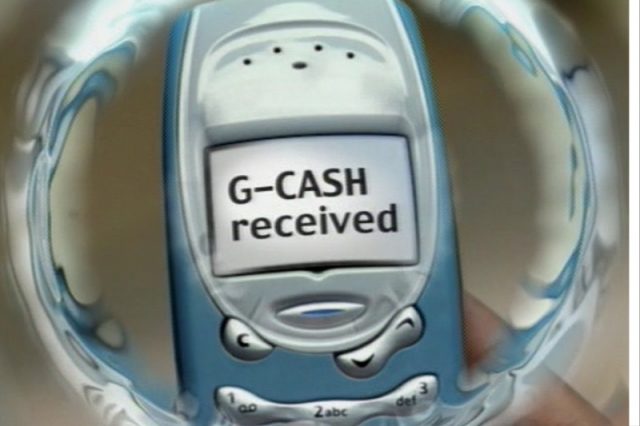

- SMS Money Transfer

In 2004, when flip phones were the height of tech, this innovation disrupted traditional money transfer by allowing users to send and receive money through simple text messages, giving millions their first taste of financial freedom.

- Buy Load

With the rise of smartphones in 2012, it was made possible for users to top up prepaid credits on the go. No more rushing to stores for loads because, with just a few taps, your phone remains connected everywhere you go. But more than prepaid loads, you can also top up mobile data, promos, and other prepaid services like Cignal TV and Konsulta MD.

- Pay Bills

Also, in 2012, it introduced Pay Bills, where users can just run the app to settle everything from electricity bills to tuition with just a few clicks. With over 1,900 billers on the platform, long lines at payment centers are now a thing of the past.

- Scan-to-Pay QR

In 2017, Scan-to-Pay QR brought the future of cashless payments to the country. This unique feature allowed users to scan a QR code to pay at stores, eliminating the need for physical cash or credit cards.

- eKYC (Electronic Know-Your-Customer)

Gone are the days of physically verifying your identity at a bank. In 2018, eKYC was launched, allowing users to complete verification through the app by scanning their ID and taking a selfie. Verification became digital, fast, and secure.

- GCredit

GCredit, launched in 2018, provided instant access to credit without the hassle of bank applications. Partnering with CIMB, they offered Filipinos a quick way to borrow money, making credit more accessible. Whether for an emergency or to pay bills, this feature has your back.

- GScore

Also, in 2018, GScore allowed users to “level up” their financial experience. The higher your GScore, the more perks you unlock, including access to lending products. It acts as a personal credit score within the app, providing greater financial freedom. Today, GScore supports 5.4 million unique borrowers—one-third of whom are small business owners, while two-thirds are women, empowering a diverse group of users.

- GSave

Introduced shortly after GScore, GSave allowed users to start saving with just a few taps, eliminating paperwork and long lines. It has since evolved into a marketplace where users can open savings accounts with partner banks like BPI, Unobank, Maybank, and CIMB—all through the app. According to Gcash, 10.9 million registered GSave users are now earning up to 15% interest on savings.

- GForest

This app is not all about saving money but also saving the environment. With GForest, it gave users a chance to help the environment while managing their money. Every transaction earns points contributing to planting real trees and helping reduce carbon emissions.

Despite being launched just five years ago, it has planted over 2.8 million trees covering an area twice the size of Quezon City through the help of its credible local and international partners. In addition, over 17 million Green Heroes and 138,000 tonnes of carbon dioxide have also been reduced.

- GInsure

In 2020, GInsure made affordable insurance accessible. With just a few taps, getting insured wasn’t intimidating anymore. It was quick, easy, and right in your pocket. From life and health, cars, travels, accidents, and even pets, this feature is your one-stop shop for all insurance needs.

- GLife

What started as a feature just for shopping and food delivery, GLife has now made life easier since it began offering everything from shopping, travel bookings, entertainment, essential services, and even insurance—all in one place. With GLife, you can access services without leaving the app.

- GGives & GLoan

By 2021, borrowing money was onto another level with GGives and GLoan, providing users with flexible installment plans for purchases and quick cash loans, simplifying borrowing. GGives lets you split your payments into easy installments, with select merchants offering 0% interest! And if you need quick cash, GLoan has you covered with loans up to PHP 125,000

- GInvest Funds

GInvest, now called GFunds, was launched in 2021, and since then, it has democratized investing. With as little as PHP 50, users can invest directly in top local and global companies from the app.

- GJobs

Powered by PasaJob, GJobs was introduced in 2021, and it can easily connect users with employment opportunities, allowing them to search for jobs and even earn referral fees by recommending friends. This feature facilitates employment and supports the growing gig economy, helping Filipinos find work that fits their skills and lifestyle.

- Global Pay

Taking things international, in 2022, Global Pay enabled users to make payments abroad through Alipay+, making cross-border transactions seamless.

- Send Money Protect (Scam Insurance)

Last year, the app partnered with Chubb to introduce Send Money Protect, adding an extra layer of security against scams like social engineering, account takeovers, or online shopping fraud for money transfers.

- GStocks PH

GStocks PH and AB Capital brought the stock market to your smartphones with another investing and saving feature. Now, anyone can invest in Philippine stocks straight from the app; no brokers are required– just a few taps will do.

- GCrypto

Also, in 2023, GCrypto, in partnership with the Philippine Digital Asset Exchange, made it easy for users to buy, sell, and trade cryptocurrency through their mobile wallets.

- GCash Visa Card

The GCash Visa Card, launched in 2023, expanded the app’s capabilities to more than just an e-wallet because it also allowed users to make purchases both online and in physical stores where Visa is accepted.

- GCash Overseas

For our kababayans abroad, GCash Oversears was a total game-changer in 2023. This feature allowed Filipinos abroad to use the app with non-Philippine SIM cards, allowing OFWs to send money and pay bills wherever they are in the world.

GCash has become more than just an app—it’s a daily necessity. From SMS transfers to a financial super app, it continues innovating, helping Filipinos stay connected, secure, and empowered economically.

These 20 features are just the tip of the iceberg because as it celebrates, it also gives back to the users who have made the app successful.

“We’ll be having numerous surprises in the app, so you’ll look forward to it the entire month. We’ll have pasabogs, giveaways, and some special deals with our merchant partners,” Trinidad added.

The giveaway includes:

- ₱100 GCash Credits for 73,000 winners

- ₱50 GCash Credits for 90,000 winners

- ₱20 GCash Credits for 150,000 winners

- ₱50,000 worth of groceries for 100 winners

- 200 Oppo A3 phones

- Yamaha motorcycles for over 100 winners

The raffle is open to all GCash users across the country and will run until the end of October, with winners being announced every 3 to 4 days.

“All you need to do is open the app, shake it, and get a chance to win. You don’t even need to buy anything,” the chief marketing officer said.

As it celebrates its 20th anniversary in the country, it’s clear the future of financial services in the Philippines is digital, and this is only the beginning.

“We kept everyone connected and moving forward. And today, we are the number one finance super app in the Philippines,” Trinidad said.