Spoofing, a scammer’s way of infiltrating people’s text messages by masquerading as a private bank, continues to prevail, according to Banco De Oro (BDO).

Here are some red flags to check to avoid being scammed by a fake text message from senders masquerading as a private bank:

Check the sender’s info

It is vital to analyze where the text message is coming from in order to discern a scam.

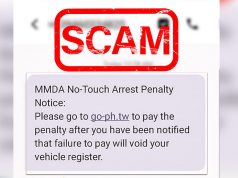

“Fraudulent messages may come from unknown 11-digit numbers or email senders, or they may even appear to be from legitimate sources, using a technique known as ‘spoofing’” BDO explained.

Some senders may even use flash short message service (SMS), a text alert typically used for strong weather warnings from the National Disaster Risk Reduction and Management Council (NDRRMC).

A couple of online users shared their experience receiving a spoofed flash SMS.

“Is this a new scam?” one person said on X (formerly Twitter).

Flash SMS Scam? How is this possible? Is this a new scam? Please do something, your customers are at risk.#bancodeoro #bdo #bdoph #bancodeoroph #bdounibank #scam #fraud @pnppio @NBIPH @PhilippineStar @inquirerdotnet pic.twitter.com/1NeDamJLEM

— 알준 (@AljhunGwapo) April 29, 2024

“Wala naman akong BDO eh,” another X user said with crying emojis.

scam ba toh? huhu wala naman akong BDO eh 😭😭 pic.twitter.com/I9L9ytE5mu

— nini (@chaaaa_borromeo) April 29, 2024

Fake login attempts

One of the most common fake texts is warning a person that their bank account has been compromised.

“Messages claiming a login attempt on an online bank account from an unfamiliar device and urging immediate action to ‘remove’ the device are likely scams,” BDO said.

This is another modus that tells the recipient that their account will be deactivated unless they update their personal details, such as mobile phone number, email address and other sensitive information by clicking a suspicious link or fake website.

“These unverified messages can cause recipients to panic and follow the instructions, such as clicking on a link that leads to a fake bank website,” the private bank added.

Once a scammer gains access to this information, it becomes vulnerable to hacking, potentially resulting in the loss of personal savings.

The best way is to not interact with any links at all and avoid sharing one-time pins (OTPs) with anyone.

Contact authorities

In order to dodge these persistent scam attacks, one must report this incident to the bank’s official pages or contact them.

“Always remember, if the message or the sender urges you to click a link or scan a QR code, it’s a scam,” BDO warned.

“Delete such messages immediately and report them to the Bank through the following channels: 22567888 (SMS) or reportphish@bdo.com.ph,” it added.

The bank also assured that a customer service representative will take care of any necessary incident reports.