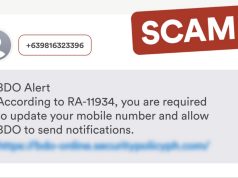

Banco de Oro, one of the largest banks in the country, cautioned its clients against downloading a supposed version its mobile app from unofficial websites.

BDO also advised that those who could not access their mobile app conduct their transactions via their official website only.

“Avoid installing BDO apps from other app distribution sites that may upload a fake version of our apps. Downloading and using these unofficial apps may compromise your login details, which can give scammers access to your accounts!” the bank said on August 24.

“Be smarter than a scammer. #BDOAntiScam,” it added.

BDO’s official apps are:

- BDO Digital Banking

- BDO Pay

- BDO Deals

- BDO Securities Mobile App

- BDO Checkout

- BDO Merchant

- BDO Unibank SG

Platforms where BDO’s clients can download these from are:

- Google Play Store: google.com/store/apps/details?id=www.pay.bdo.com.ph

- Apple App Store: apple.com/ph/app/bdo-pay/id1381315990

- Huawei App Gallery: cloud.huawei.com/ag/n/app/C103937877?locale=en_US&source=appshare&subsource=C103937877

“Meanwhile, clients who are unable to download the mobile apps are encouraged to use the web version,” BDO said.

A cybersecurity firm had observed a surge in cybersecurity threats in the Philippines amid the massive shift of Filipinos from onsite to online transactions.

READ: Over 55,500 password stealers detected in the Philippines, says cybersecurity firm

In a research study released in May, Kaspersky recorded a total of 55,597 password stealers in the country during the first three months of the year, which was a 25% increase from the same period in 2020.

This is also seen in countries in Southeast Asia, citing the overall digital shift amid the still raging pandemic.

“It is known that Southeast Asia homes the most active social media users in the world. At the same time, the region is witnessing a massive digital shift at a breakneck speed. We are now 400-million-strong online consumers, a number predicted to happen not until 2025,” said Yeo Siang Tiong, the firm’s general manager for Southeast Asia.

“Hence, it is expected that cybercriminals would be very interested to take over our virtual accounts brimming with financial and confidential data,” he added.