A private bank is calling on its clients to download its new mobile application by September.

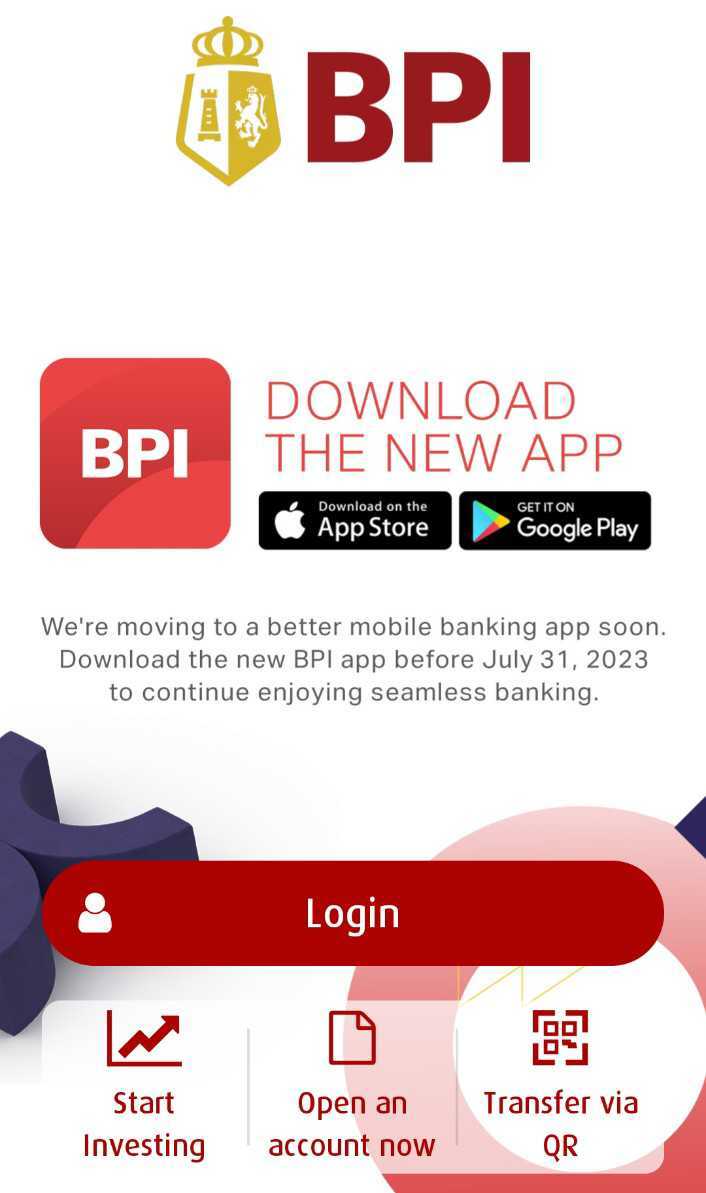

The Bank of the Philippine Islands (BPI) rolled out its new mobile app on March 1. It is now available on all Google Play and Apple Store for free.

BPI earlier advised customers that the deadline to download its new app was before July 31. This advisory can also be found on the homepage of the bank’s old app.

“We’re moving to a better mobile banking app soon. Download the new BPI app before July 31, 2023, to continue enjoying seamless banking,” it reads.

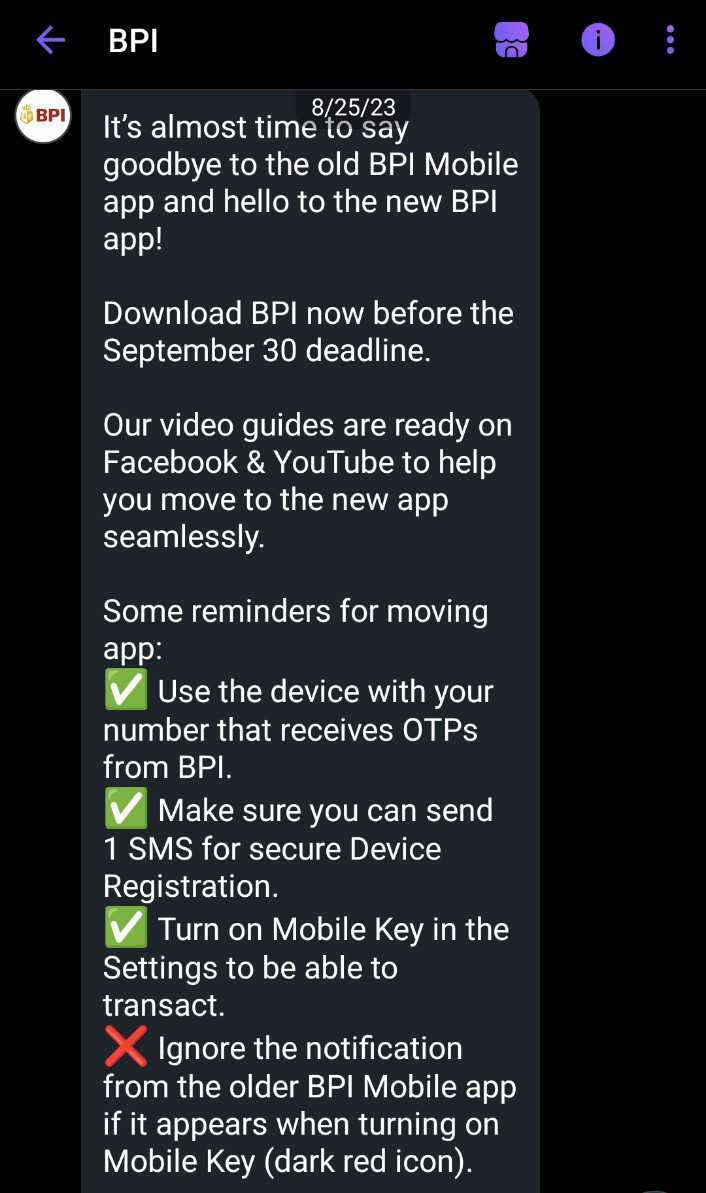

On August 25, in an advisory sent via its verified Viber account, BPI set a new deadline for the transfer—September 30.

“It’s almost time to say goodbye to the old BPI Mobile app and hello to the new BPI app! Download BPI now before the September 30 deadline,” the bank said.

BPI also posted a graphic that showed the old app’s thumbnail where it bears its logo. The new app’s design, meanwhile, is minimalist wherein it only has the bank’s name against its red brand hue.

BPI also listed the following reminders during the shift:

- Use the device with your number that receives OTPs from BPI.

- Make sure you can send one SMS for secure Device Registration.

- Turn on Mobile Key in the Settings to be able to transact.

For added security, BPI also advised customers to ignore notifications from the older BPI app if they have downloaded and activated the new one.

“Ignore the notification from the older BPI Mobile app if it appears when turning on Mobile Key (dark red icon),” it said.

In a previous statement, BPI President and CEO TG Limcaoco said that the company launched a new mobile app to offer an enhanced user experience to its clients.

“I’m so proud of this new app because it builds so many things into it that make us better. For one, it’s a new, improved, younger, and more modern user experience. And the thing I’m most excited about is that, eventually, we will have AI-powered personal finance that will advise you on how to build your savings and plan,” Limcaoco said.

Aside from a minimalist design, customers can also see AI-powered insights into their personal financial transactions.

“Get critical transaction alerts and meaningful reports on your spending and savings,” BPI said in a new post about this update.