A major banking firm introduced a new deposit product effective in June after receiving complaints from Maxi-Saver clients over some policy changes.

The Bank of the Philippine Islands (BPI) earlier announced that clients who have Peso Maxi-Saver Savings Accounts or Maxi Saver accounts must maintain a hefty P2 million average daily balance (ADB) requirement.

This deposit account is different from the regular savings and current bank accounts of majority of its clients.

In the advisory released last March, BPI said that the new rates to the Maxi-Saver’s Terms and Conditions will be implemented on June 1 amid the still raging novel coronavirus pandemic.

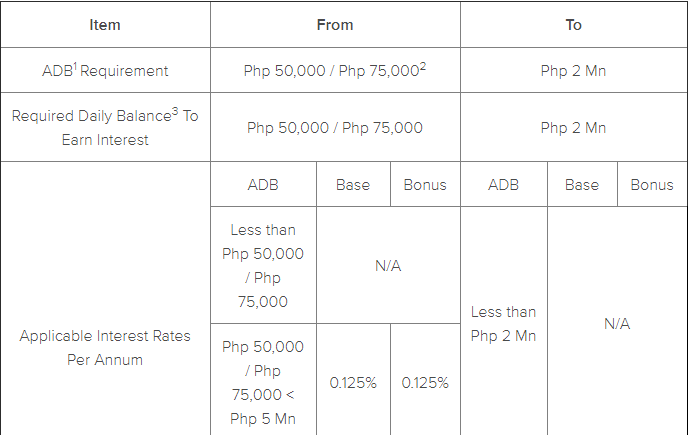

The minimum daily balance of its Maxi-Saver only ranges from P50,000 and P75,000 for both debit card and passbook before the policy changes.

The bank also stated that these changes will be applied on Maxi- Saver debit card and passbook users.

Clients who will fail to meet this new requirement will incur P300 monthly service change.

“We will be communicating to customers with Peso Maxi-Saver Savings Accounts in the coming weeks about these changes to the above-stated deposit product. Kindly ensure that your contact details with the bank are updated,” part of the advisory read.

BPI announced these changes at a time when most Filipinos are still reeling from the financial impact of the pandemic and thousands of COVID-19 infections are recorded every day.

Social media users pointed these concerns out as they aired their complaints against the bank.

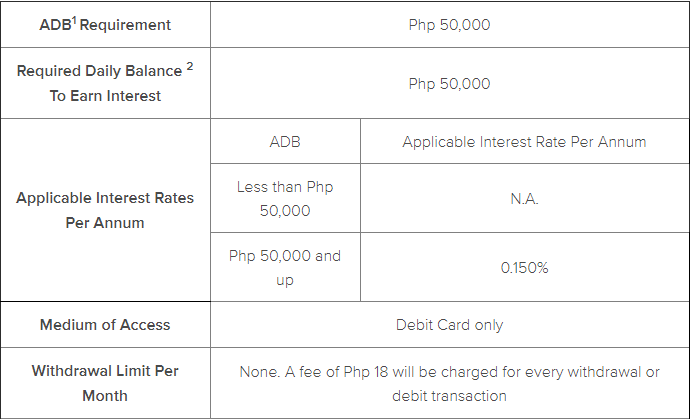

Following the online backlash, the bank then issued a new advisory on April 15 where a new product called BPI Saver Plus Savings Account was announced.

“Effective June 1, 2021, we are pleased to announce that a new deposit product, BPI Saver Plus Savings Account, will be launched,” read the new advisory.

To those who wish to apply, the ADB requirement is at least P50,000.

The monthly charge remains at P300 for those who failed to meet the ADB.

As of writing, here are the basic product features provided:

Complaints vs changes in Maxi-Saver policy

Some Filipinos questioned the sudden policy changes and the penalty fees, perceiving it too high amid the trying times.

“Such a short amount of time to give notice. A chance to steal 300 pesos every 2 months from unknowing customers!” a Facebook user said.

“This is crazy, money is with them. They use it to earn income, tapos charge ng P300 if nag fall below minimun? Greed!” another user wrote.

Other Filipinos, meanwhile, voiced out that BPI places its clients health and safety at risk with the new policies.

“Can’t banks have a moratorium on deposits until the pandemic is over? Yung wala munang dormancy policies, sudden deposit policy changes? Banks should cooperate in reducing transmission,” a Twitter user said.

“Wow I really hate BPI right now. This maxi saver update could force me to close my account. And the only way to do that? Go personally to the bank. In. This. Raging. Pandemic,” another commented.